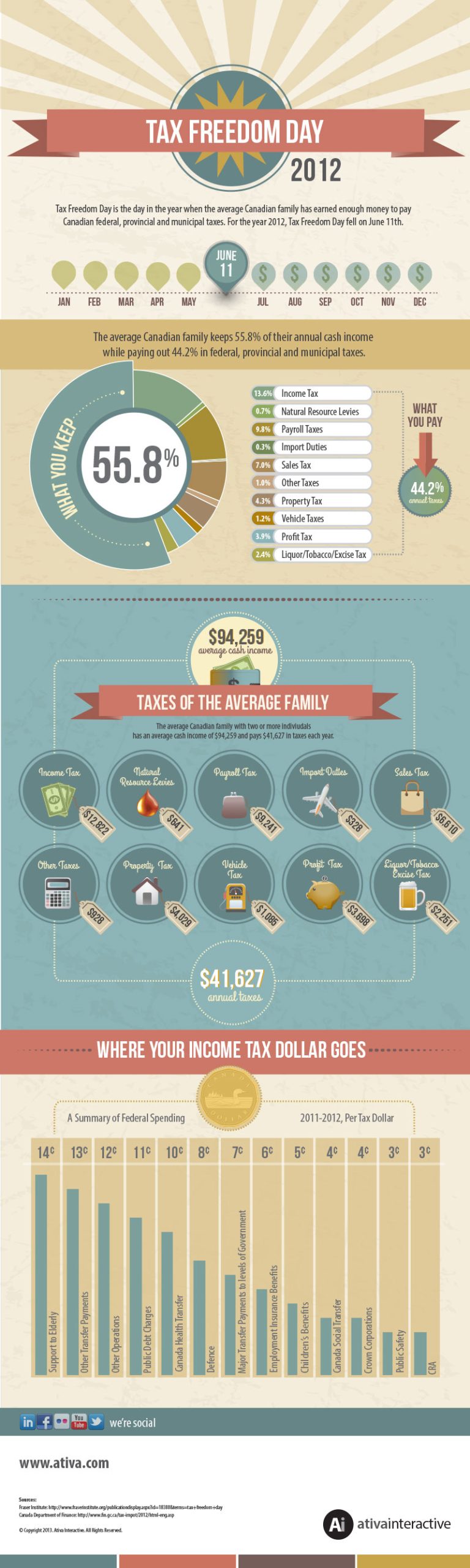

Tax Freedom Project

Tax Freedom Project: Empowering Individuals to Take Control of Their Finances In today’s world, taxes are an inevitable part of our lives. Whether we like it or not, we have to pay our fair share to the government. However, what if there was a way to minimize the burden of taxes and take control of … Read more