Income Tax can be a complex topic, with various rules and regulations to navigate. However, understanding and taking advantage of available tax credits can make a significant difference in your financial situation. One such credit is the Earned Income Tax Credit (EITC). In this article, we will explore the details of the EITC for the year 2024 and how it can benefit eligible taxpayers.

**What is the Earned Income Tax Credit (EITC)?**

The Earned Income Tax Credit (EITC) is a federal tax credit designed to provide financial assistance to low and moderate-income individuals and families. It rewards individuals who work and have earned income, but whose income falls below a certain threshold.

Qualifying Criteria for EITC

To qualify for the Earned Income Tax Credit (EITC), certain criteria must be met. Here are the key factors to consider:

Income Limits

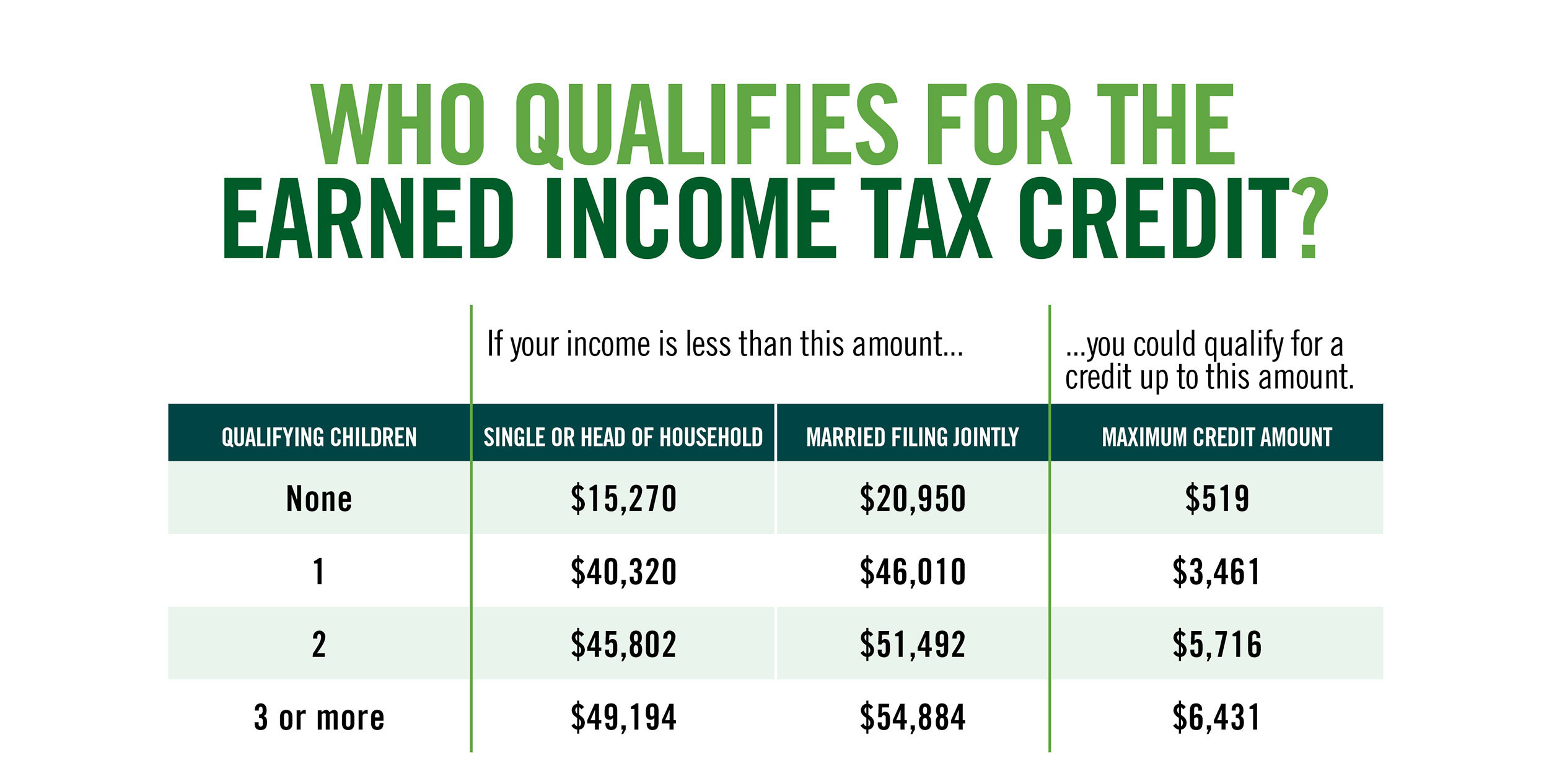

The primary factor in determining eligibility for the EITC is the individual or family’s income level. The income limits for the EITC are adjusted annually. For the tax year 2024, the income limits are as follows:

– Single filers or those filing as Head of Household:

– No qualifying children: maximum income of $15,980

– One qualifying child: maximum income of $42,158

– Two qualifying children: maximum income of $47,915

– Three or more qualifying children: maximum income of $51,464

– Married filing jointly:

– No qualifying children: maximum income of $21,920

– One qualifying child: maximum income of $48,198

– Two qualifying children: maximum income of $53,955

– Three or more qualifying children: maximum income of $57,504

Filing Status

The individual or family must also choose one of the following filing statuses to qualify for the EITC:

– Single or Head of Household

– Married filing jointly

– Qualifying widow(er) with a dependent child

Age Requirements

The age of the taxpayer and any qualifying children also plays a role in determining eligibility for the EITC. Generally, the taxpayer must be between the ages of 25 and 65. However, there are exceptions for individuals with qualifying disabilities and those with qualifying children.

Benefits of the Earned Income Tax Credit (EITC)

The EITC provides several benefits for eligible taxpayers. Here are some key advantages:

Increased Refund

One of the most significant benefits of the EITC is that it can result in a larger tax refund. For individuals and families with low to moderate incomes, this extra money can make a substantial difference, helping to cover various expenses or build savings.

Reduced Tax Liability

Even if you do not qualify for a refund, the EITC can still reduce your tax liability. It can directly offset the amount of tax you owe, potentially resulting in a lower tax bill.

Incentive to Work

The EITC is specifically designed to incentivize work for individuals with low to moderate incomes. By providing financial assistance, it encourages individuals to enter or remain in the workforce.

Phase-out Range

The EITC features a phase-out range, which means the credit gradually reduces as income increases. This helps ensure that the benefits primarily target those with the greatest need. However, it’s essential to be aware of the income limits to avoid losing eligibility.

Frequently Asked Questions

Now that we have discussed the basics of the Earned Income Tax Credit (EITC), let’s address some common questions that taxpayers may have:

Q: Who can claim the EITC?

A: The EITC can be claimed by eligible individuals or families who meet the income, filing status, and age requirements outlined by the IRS.

Q: How much money can I receive from the EITC?

A: The amount of money you can receive from the EITC depends on various factors, including your income level, filing status, and the number of qualifying children you have. The maximum credit amount for the tax year 2024 is $6,728 for families with three or more qualifying children.

Q: Can I claim the EITC if I am self-employed?

A: Yes, self-employed individuals can still be eligible for the EITC if they meet the qualifying criteria. However, additional documentation and income verification may be required.

Q: Do I have to file a tax return to claim the EITC?

A: Yes, you must file a federal tax return in order to claim the EITC. Additionally, you must include any required supporting documentation and complete the necessary forms provided by the IRS.

Final Thoughts

The Earned Income Tax Credit (EITC) can provide significant financial assistance to individuals and families with low to moderate incomes. By taking advantage of this tax credit, eligible taxpayers can reduce their tax liability or even receive a larger tax refund. It’s essential to understand the qualifying criteria and keep up to date with the income limits for each tax year to ensure you maximize the benefits available to you. Remember to consult with a tax professional or use reputable tax software to ensure accuracy when claiming the EITC.