Are you searching for information about Colorado state tax forms for the year 2014? Well, you’ve come to the right place! In this article, we will guide you through everything you need to know about Colorado state tax forms for the year 2014. From understanding the different forms to helpful tips for filling them out correctly, we’ve got you covered. Let’s dive right in!

Colorado state tax forms for the year 2014 are an essential part of filing your taxes accurately and efficiently. Whether you’re a resident of Colorado or earned income in the state during that year, these forms play a crucial role in determining your tax liability. Let’s break down everything you need to know about Colorado state tax forms for 2014.

Understanding Colorado State Tax Forms for 2014

When it comes to filing your state taxes, it’s important to have a clear understanding of the forms you need to use. For the year 2014, Colorado taxpayers typically need to use the following forms:

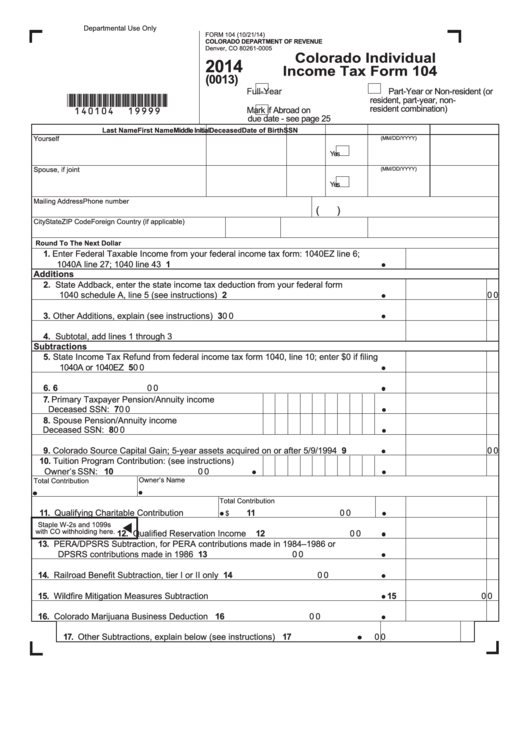

1. Form 104

Form 104, also known as the “Colorado Individual Income Tax Return,” is the primary form used to report your income and calculate your state tax liability for the year 2014. This form is used by both residents and non-residents of Colorado who earned income within the state during that year.

2. Form 104PN

If you were a part-year resident of Colorado in 2014, meaning you lived in the state for only a portion of the year, you will likely need to file Form 104PN. This form is specifically designed for individuals who moved in or out of Colorado during the tax year.

3. Form 104CR

Form 104CR, also known as the “Individual Credit Schedule,” is used to claim various credits that can help reduce your tax liability. If you qualify for any of the available tax credits, such as the Child Care Expenses Credit or the Colorado Child Care Contribution Credit, you will need to complete this form.

4. Form 104EP

Form 104EP, also known as the “Estimated Tax Payment Form,” is used to make estimated tax payments throughout the year. If you anticipate owing a significant amount in state taxes for the year 2014, it may be necessary to make quarterly estimated tax payments using this form.

Tips for Filling Out Colorado State Tax Forms

Now that you have a basic understanding of the different Colorado state tax forms for 2014, let’s explore some tips to help you fill them out correctly. Pay close attention to the following pointers:

1. Gather All Necessary Documents

Before starting the process of filling out your tax forms, gather all the relevant documents you’ll need. This includes W-2 forms received from your employers, 1099 forms for any additional income, and any other supporting documents related to your income or deductions.

2. Double-Check Your Social Security Number

It is crucial to ensure that your Social Security number is entered correctly on your tax forms. One small mistake can lead to delays in processing your return or potential issues with the IRS.

3. Enter Your Income Accurately

Take the time to accurately report all income sources on your tax forms. This includes income from employment, self-employment, investments, rental properties, and any other sources of income you may have earned throughout the year.

4. Don’t Forget Deductions and Credits

Be sure to claim any deductions and credits you are eligible for on your tax forms. This can include deductions for student loan interest, medical expenses, and education-related expenses. Additionally, don’t forget to claim any tax credits for which you qualify.

5. Check for Errors

Before submitting your tax forms, carefully review them for any errors or omissions. Simple mistakes, such as incorrect calculations or missing information, can lead to delays in processing or potential audit triggers.

Frequently Asked Questions

Q: Can I e-file my Colorado state tax forms for the year 2014?

A: Yes, Colorado state tax forms for the year 2014 can be filed electronically. Visit the Colorado Department of Revenue’s website for more information on e-filing options.

Q: What is the deadline for filing Colorado state tax forms for the year 2014?

A: For the year 2014, the deadline to file Colorado state tax forms was April 15, 2015. Be sure to check for any applicable extensions or deadline changes if you are filing late.

Q: Can I amend my Colorado state tax forms for the year 2014?

A: Yes, if you discover an error on your previously filed Colorado state tax forms for the year 2014, you can file an amended return using Form 104X.

Final Thoughts

Filing your Colorado state tax forms for the year 2014 doesn’t have to be a stressful experience. By understanding the different forms and following the tips mentioned above, you can navigate the process with confidence. Remember to double-check all information before submitting your forms and keep copies for your records. If you have any specific questions or concerns, it’s always best to consult with a tax professional or the Colorado Department of Revenue for personalized guidance. Happy filing!