**Oklahoma 2018 Tax Forms: Everything You Need to Know**

If you’re a resident of Oklahoma, you may be wondering about the tax forms you need to fill out for the year 2018. Whether you’re a seasoned taxpayer or this is your first time filing taxes, understanding the process can be overwhelming. In this article, we’ll provide you with a comprehensive guide to Oklahoma’s 2018 tax forms, so you can navigate the process with ease.

Understanding Oklahoma Tax Forms

Before diving into the specifics of Oklahoma’s tax forms, it’s important to have a basic understanding of how the state’s tax system works. Oklahoma collects income tax from its residents, which is used to fund public services and infrastructure. To determine the amount of tax owed, individuals must report their income, deductions, and credits on the appropriate tax forms.

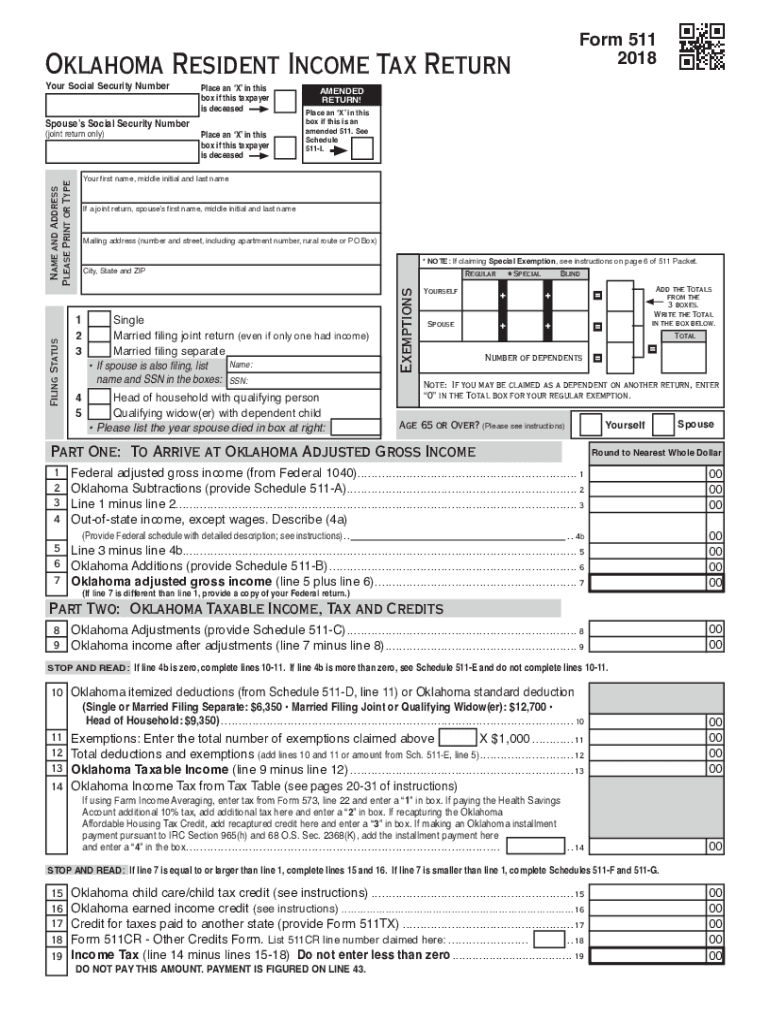

Oklahoma Form 511

The Oklahoma Form 511 is the standard individual income tax form for Oklahoma residents. This form should be used by individuals who are full-year residents of Oklahoma and need to report their income, deductions, and credits. It covers various sources of income, including wages, salaries, tips, interest, and dividends.

When filling out the Form 511, you’ll need to provide your personal information, such as your name, address, and Social Security number. You’ll also need to report your income, deductions, and credits. Be sure to review the form instructions carefully to ensure accurate reporting.

Oklahoma Form 511NR

For individuals who were non-residents of Oklahoma but earned income within the state, the Oklahoma Form 511NR is the appropriate form to use. This form is specifically designed for part-year residents or non-residents who have income from Oklahoma sources. It helps determine the amount of tax owed based on the portion of income earned in Oklahoma.

Similar to the Form 511, the Form 511NR requires individuals to provide personal information and report their income, deductions, and credits. Non-residents and part-year residents should consult the form instructions to ensure accurate reporting.

Common Deductions and Credits

When filing your Oklahoma tax forms, you’ll have the opportunity to claim various deductions and credits to reduce your tax liability. Here are some common deductions and credits available to Oklahoma taxpayers:

Standard Deduction

The standard deduction is a fixed amount that reduces your taxable income. For the tax year 2018, Oklahoma offers a standard deduction of $6,350 for single filers and $12,700 for married couples filing jointly.

Itemized Deductions

If your total itemized deductions exceed the standard deduction amount, you may choose to itemize deductions instead. Some common itemized deductions include mortgage interest, state and local taxes, medical expenses, and charitable contributions.

Child Tax Credit

The child tax credit allows you to claim a credit for each qualifying child under the age of 17. For the tax year 2018, the credit is $100 per child.

Earned Income Tax Credit

The earned income tax credit (EITC) is a credit designed to assist low to moderate-income taxpayers. The credit amount varies based on income and family size. It can provide a significant reduction in tax liability for eligible individuals.

Frequently Asked Questions

Q: How do I obtain Oklahoma tax forms?

A: Oklahoma tax forms can be obtained online through the Oklahoma Tax Commission’s website. You can download and print the forms you need or file electronically through the state’s online filing system.

Q: What is the deadline for filing Oklahoma tax forms?

A: The deadline for filing Oklahoma tax forms is generally April 15th, coinciding with the federal tax deadline. However, if April 15th falls on a weekend or holiday, the deadline may be extended to the following business day.

Q: What if I need more time to file my Oklahoma tax forms?

A: If you’re unable to file your Oklahoma tax forms by the deadline, you may request an extension. The extension grants an additional six months to file your return, but any taxes owed must still be paid by the original filing deadline.

Q: Can I file my Oklahoma tax forms electronically?

A: Yes, Oklahoma offers an online filing system that allows residents to file their tax forms electronically. Electronic filing is generally faster and more convenient than paper filing.

Final Thoughts

Filing taxes can be a complex and time-consuming process, but understanding the specific requirements of Oklahoma’s tax forms can help ease the burden. By familiarizing yourself with the Form 511 and Form 511NR, as well as the available deductions and credits, you’ll be better equipped to navigate the Oklahoma tax system.

Remember to keep accurate records of your income, deductions, and credits throughout the year to ensure a smooth filing process. If you have any questions or need assistance, don’t hesitate to reach out to the Oklahoma Tax Commission or seek professional tax advice.

Filing your taxes may seem daunting, but with the right information and resources, you can successfully complete your Oklahoma tax forms and meet your filing obligations.