**Does North Carolina Have State Income Taxes?**

If you’re a resident of North Carolina or considering a move to the Tar Heel State, one of the questions on your mind might be whether or not North Carolina imposes state income taxes. The answer is yes. North Carolina does have state income taxes that residents are required to pay.

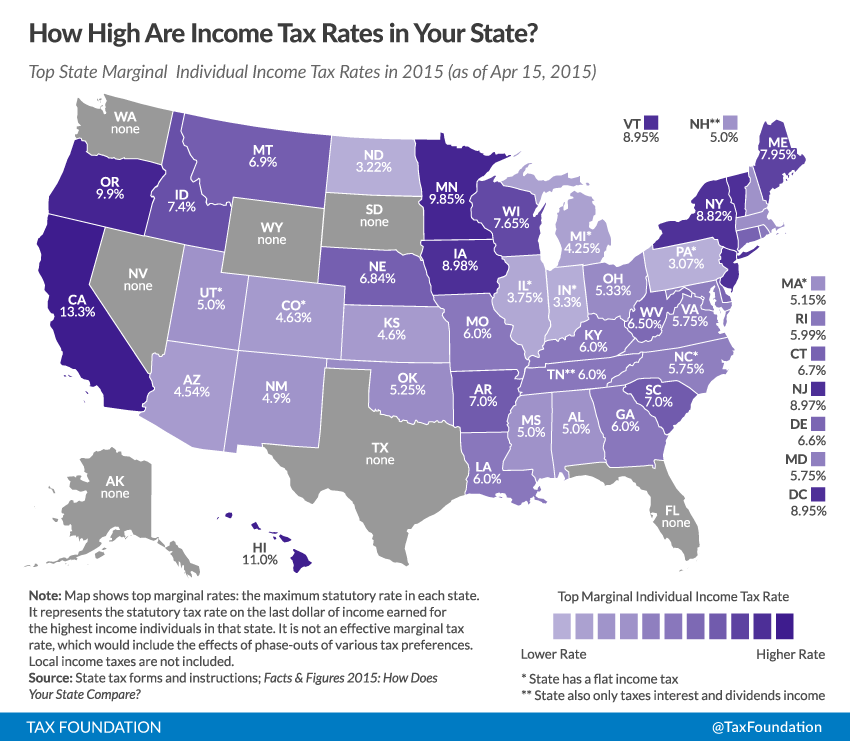

North Carolina has a progressive income tax system, which means that individuals with higher incomes pay a higher rate of tax. The tax rates in North Carolina range from 5.25% to 7.5% for individual income, depending on your level of income. For married couples filing jointly, the tax rates range from 5.25% to 7.5% as well. Additionally, North Carolina offers standard deductions and a variety of tax credits and exemptions that can help lower your overall tax liability.

Understanding North Carolina State Income Taxes

Now that we know that North Carolina does have state income taxes, let’s dive deeper into the topic and explore some key points about how the tax system works in the state.

Tax Rates and Brackets

As mentioned earlier, North Carolina has a progressive tax system, which means that tax rates increase as your income increases. Here are the current tax rates and brackets for North Carolina as of 2021:

– 5.25% for income up to $21,250 (single filers) or $42,500 (married filing jointly)

– 5.75% for income between $21,251 and $84,500 (single filers) or $42,501 and $169,000 (married filing jointly)

– 6.75% for income between $84,501 and $213,300 (single filers) or $169,001 and $426,600 (married filing jointly)

– 7.5% for income over $213,300 (single filers) or $426,600 (married filing jointly)

Deductions and Exemptions

North Carolina offers several deductions and exemptions that can help reduce your taxable income. Here are some of the most common ones:

– Standard Deduction: For 2021, the standard deduction is $10,750 for individuals and $21,500 for married couples filing jointly.

– Personal Exemption: North Carolina does not offer a personal exemption, but it does offer an additional deduction for taxpayers age 65 or older or blind.

– Itemized Deductions: If you choose to itemize your deductions, you can deduct expenses such as mortgage interest, property taxes, medical expenses, and charitable contributions. However, it’s important to note that North Carolina has certain limitations and restrictions on itemized deductions.

Tax Credits

North Carolina also provides various tax credits that can directly reduce your tax liability. Some of the common tax credits include:

– Child and Dependent Care Credit: This credit is available for expenses incurred for the care of a qualifying child or dependent.

– Education credits: North Carolina offers credits for qualified expenses related to higher education, such as the American Opportunity Credit and the Lifetime Learning Credit.

– Renewable Energy Tax Credit: If you’ve made eligible renewable energy expenditures in North Carolina, you may be eligible for this credit.

Frequently Asked Questions

Do I have to file a North Carolina state tax return?

Whether or not you need to file a North Carolina state tax return depends on your income level and filing status. If you’re a resident and your income exceeds the minimum filing requirements set by the state, you will need to file a tax return.

When is the deadline to file North Carolina state taxes?

The deadline to file your North Carolina state tax return is typically April 15th. However, due to the COVID-19 pandemic, the deadline for filing 2020 state tax returns was extended to May 17th, 2021.

Can I e-file my North Carolina state tax return?

Yes, North Carolina allows taxpayers to e-file their state tax returns. E-filing is a convenient and secure way to file your taxes and receive any refunds owed to you.

What happens if I don’t pay my North Carolina state income taxes?

If you fail to pay your North Carolina state income taxes on time, you may be subject to penalties and interest charges. It’s important to pay your taxes in full and on time to avoid these additional costs.

Final Thoughts

Understanding North Carolina state income taxes is crucial for residents and those considering a move to the state. By familiarizing yourself with the tax rates, deductions, and credits available, you can effectively manage your tax liability and ensure compliance with state tax laws. Remember to consult with a tax professional or use reliable tax software to accurately prepare and file your North Carolina state tax return each year.