Are you curious about the 2022 Earned Income Credit (EIC)? Wondering how it may impact your finances? In this article, we’ll dive into all the important details surrounding the EIC and help you understand how it works, who qualifies, and how much you may be eligible to receive.

**What is the 2022 Earned Income Credit?**

The 2022 Earned Income Credit, also known as the EIC or EITC, is a tax credit designed to provide financial assistance to low-income individuals and families. It is a refundable credit, meaning that if the amount of the credit exceeds the amount of taxes owed, the taxpayer will receive the difference as a tax refund.

Who Qualifies for the 2022 Earned Income Credit?

To qualify for the 2022 Earned Income Credit, you must meet certain eligibility criteria. These criteria include:

1. **Earned Income**: You must have earned income from employment or self-employment. Investment income does not count toward the EIC.

2. **Filing Status**: You must file your tax return as Single, Married Filing Jointly, Head of Household, or Qualifying Widow(er) with Dependent Child.

3. **Citizenship or Resident Status**: You must be a U.S. citizen or resident alien for the entire year.

4. **Work Requirement**: You must have worked for at least part of the year. There are special rules for individuals who are receiving disability benefits or are serving in the military.

5. **Investment Income Limit**: Your investment income for the year must be $3,650 or less. If your investment income exceeds this limit, you will not be eligible for the EIC.

How Much Can You Receive with the 2022 Earned Income Credit?

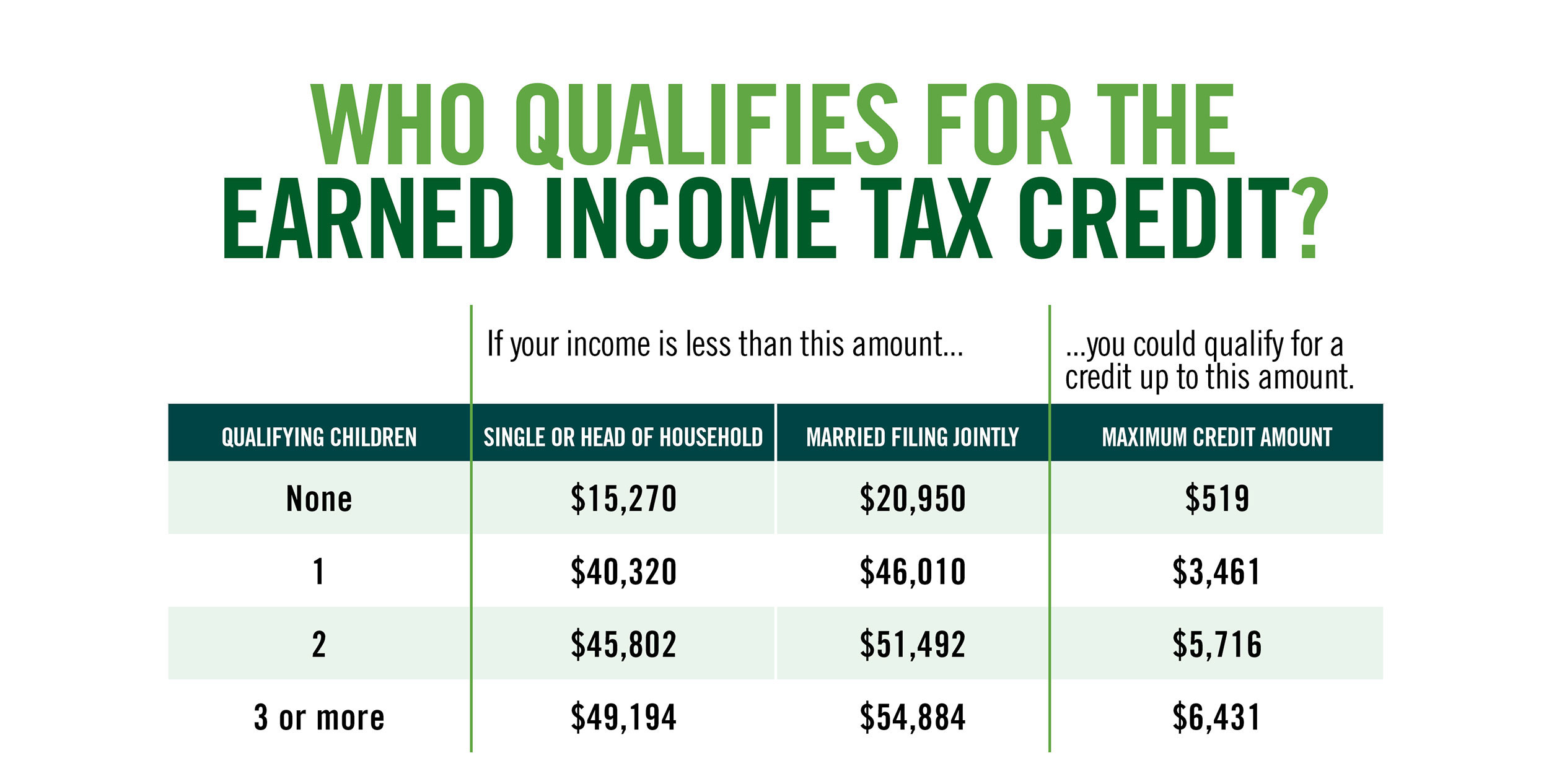

The amount of the 2022 Earned Income Credit varies based on a few factors, including your income, filing status, and the number of qualifying children you have. The more children you have, the higher the credit amount you may be eligible for.

Here is the breakdown of the maximum credit amounts for different situations:

– **No qualifying children**: Up to $538

– **One qualifying child**: Up to $3,684

– **Two qualifying children**: Up to $5,920

– **Three or more qualifying children**: Up to $6,660

It’s important to note that these are the maximum amounts, and the actual credit you may receive will depend on your income and filing status. The IRS provides an Earned Income Credit table that you can use to determine your exact credit amount.

How to Claim the 2022 Earned Income Credit?

To claim the 2022 Earned Income Credit, you need to file a tax return, even if you are not required to do so. You will need to fill out the appropriate forms and schedules, such as Form 1040 or 1040A, along with Schedule EIC.

Make sure to accurately calculate your income, deductions, and credits to determine your eligibility for the EIC. The IRS provides detailed instructions and resources to help you correctly claim the credit.

Frequently Asked Questions

1. Can I claim the Earned Income Credit if I’m self-employed?

Yes, self-employed individuals can qualify for the Earned Income Credit. You will need to report your self-employment income and expenses accurately on your tax return to determine your eligibility.

2. Can I still receive the credit if I have no income tax liability?

Yes, the Earned Income Credit is a refundable credit, which means you can receive a refund even if you don’t owe any income tax. If the amount of the credit exceeds your tax liability, the difference will be refunded to you.

3. Is there an age limit to qualify for the EIC?

There is no age limit to qualify for the Earned Income Credit. However, if you do not have a qualifying child, you must be between the ages of 25 and 65.

4. What happens if my income changes during the year?

If your income changes during the year, it may affect your eligibility and the amount of the Earned Income Credit you can claim. It’s important to update your income information when filing your taxes to ensure you receive the proper credit amount.

5. How long does it take to receive the EIC refund?

The timing of your EIC refund will vary depending on various factors, including when you filed your tax return and how you chose to receive your refund (direct deposit or by mail). On average, the IRS issues refunds within 21 days of receiving a correctly filed return.

Final Thoughts

The 2022 Earned Income Credit can provide significant financial assistance to low-income individuals and families. If you meet the eligibility criteria, make sure to claim the credit when filing your tax return. The IRS provides valuable resources and assistance to help you navigate the EIC process correctly. Remember to consult with a tax professional if you have specific questions or need further guidance.