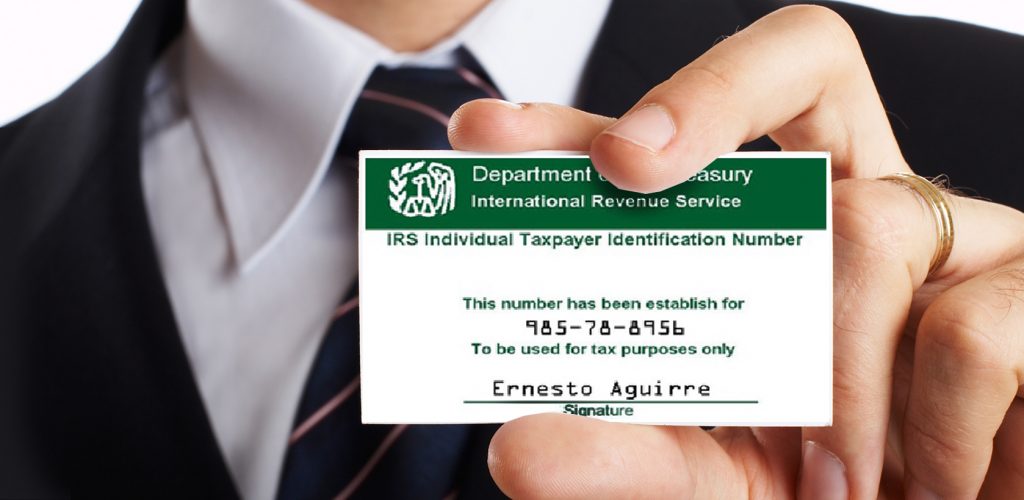

Can You Claim the Earned Income Credit (EIC) with an ITIN?

If you’re a taxpayer with an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number (SSN), you may be wondering if you’re eligible to claim the Earned Income Credit (EIC). The EIC is a tax credit that benefits low to moderate-income individuals and families. It’s designed to provide financial assistance and reduce the tax burden for those who qualify.

The answer to whether you can claim the EIC with an ITIN is no. The EIC is only available to individuals who have a valid Social Security Number. This requirement is outlined in the Internal Revenue Service (IRS) guidelines. If you have an ITIN, you are ineligible for the EIC, regardless of your income or other qualifying factors.

Why Can’t You Claim the EIC with an ITIN?

The reason behind this restriction is rooted in the purpose and intent of the EIC. The EIC was established to provide assistance to low to moderate-income individuals who have a valid Social Security Number. This requirement ensures that the tax credit is only available to individuals who are legally authorized to work and are contributing to the Social Security system.

By limiting the EIC to those with an SSN, the IRS aims to prevent fraud and abuse of the tax credit program. Requiring a Social Security Number helps to verify the identity and eligibility of individuals claiming the credit. It also ensures that the individuals receiving the EIC are actively engaged in the workforce and contributing to the economy.

Alternative Tax Credits for ITIN Holders

While ITIN holders cannot claim the EIC, there are other tax credits and deductions that may be available to them. Here are a few options worth exploring:

Child Tax Credit (CTC)

The Child Tax Credit provides a tax benefit to individuals with qualifying children. To claim this credit, you must meet certain criteria, including having a qualifying child, meeting income requirements, and having a valid SSN for yourself, your spouse (if applicable), and your child. Unfortunately, if you only have an ITIN, you won’t be eligible for the CTC.

Additional Child Tax Credit (ACTC)

The Additional Child Tax Credit is a refundable credit that may be available to taxpayers who have a valid SSN for themselves, their spouse, and at least one child. The ACTC can help offset the cost of raising children and can result in a refund even if you have no tax liability. However, individuals with only an ITIN are not eligible for the ACTC.

American Opportunity Credit (AOC)

The American Opportunity Credit is a tax credit available to eligible students who are pursuing higher education. To claim the AOC, you must have a valid SSN, be enrolled at least half-time in a degree or certificate program, and meet other requirements. ITIN holders are not eligible for the AOC.

Other Tax Deductions

While tax deductions reduce your taxable income rather than directly providing a credit, they can still help lower your overall tax liability. Some deductions that may be available to ITIN holders include the standard deduction, deductions for business expenses if you are self-employed, or deductions for certain types of investment income. Be sure to consult with a tax professional or refer to IRS guidelines to understand which deductions may apply to your situation.

Frequently Asked Questions

Q: Can I apply for a Social Security Number if I only have an ITIN?

A: If you are eligible to apply for a Social Security Number, it is advisable to do so. Having an SSN can open up more opportunities for employment, benefits, and tax credits. Consult with the Social Security Administration (SSA) for guidance on obtaining an SSN.

Q: Are there any exceptions to the EIC rule for ITIN holders?

A: No, there are no exceptions. The requirement for a valid SSN to claim the EIC applies to all taxpayers, regardless of their income or other qualifying factors.

Q: Can ITIN holders still file their taxes?

A: Yes, ITIN holders are required to file their taxes using Form 1040NR or Form 1040NR-EZ. These forms are specifically designed for individuals who are not eligible for an SSN but have tax filing obligations.

Q: Can ITIN holders still receive a tax refund?

A: Yes, ITIN holders can still receive a tax refund if they have overpaid their taxes. However, they are ineligible for certain refundable tax credits like the EIC and ACTC.

Final Thoughts

While ITIN holders are ineligible for the Earned Income Credit, there are other tax credits and deductions they may be eligible for. It’s important to explore these options and consult with a tax professional to ensure you are maximizing your available tax benefits. If you have an ITIN and are unsure about your tax obligations and potential credits, seek guidance from a qualified tax advisor who can provide personalized advice based on your specific circumstances. Remember, understanding the tax code and staying informed about tax credits and deductions can help you make the most of your financial situation, regardless of your ITIN status.