Are you a parent looking for ways to ease the financial burden of child care expenses? If so, you may be eligible for the Child Care Tax Credit. This tax credit can help offset the costs of child care and make it more affordable for working parents. In this article, we will explore the ins and outs of the Child Care Tax Credit, including who is eligible, how to claim it, and how much you can expect to receive.

What is the Child Care Tax Credit?

The Child Care Tax Credit is a tax benefit provided by the government to help working parents cover the costs of child care. It is meant to alleviate some of the financial strain that comes with balancing work and raising a family. By claiming this tax credit, eligible parents can reduce their overall tax liability and potentially receive a refund.

Who is eligible for the Child Care Tax Credit?

To be eligible for the Child Care Tax Credit, you must meet certain criteria. Here are the key requirements:

1. Qualifying child

– You must have one or more qualifying children under the age of 13.

– The child must be your dependent, meaning they live with you for at least half of the year.

2. Earned income

– You and your spouse, if applicable, must have earned income from a job or self-employment.

– Unemployment compensation, Social Security benefits, and investment income do not count as earned income.

3. Child care expenses

– You must have incurred child care expenses to allow you to work or look for work.

– Qualifying expenses include payments made to a daycare center, nanny, or babysitter.

4. Work-related expenses

– Your child care expenses must be considered work-related. This means they are necessary for you to work or seek employment.

– Expenses for extracurricular activities or overnight camps are not eligible for the tax credit.

How to claim the Child Care Tax Credit?

Claiming the Child Care Tax Credit is a straightforward process. Here’s what you need to do:

1. Obtain the necessary forms

– To claim the tax credit, you will need to fill out Form 2441, Child and Dependent Care Expenses.

– You can find this form on the Internal Revenue Service (IRS) website or request a copy by calling their toll-free number.

2. Gather documentation

– Collect all relevant documents, such as receipts or invoices, that prove your child care expenses.

– You may also need to provide the name, address, and taxpayer identification number of your child care provider.

3. Calculate your credit

– Follow the instructions on Form 2441 to calculate your Child Care Tax Credit.

– The credit amount is based on a percentage of your qualifying child care expenses, with a maximum limit.

4. File your tax return

– Include Form 2441 with your annual tax return when you file with the IRS.

– Be sure to keep a copy of all documentation for your records.

How much can you expect to receive?

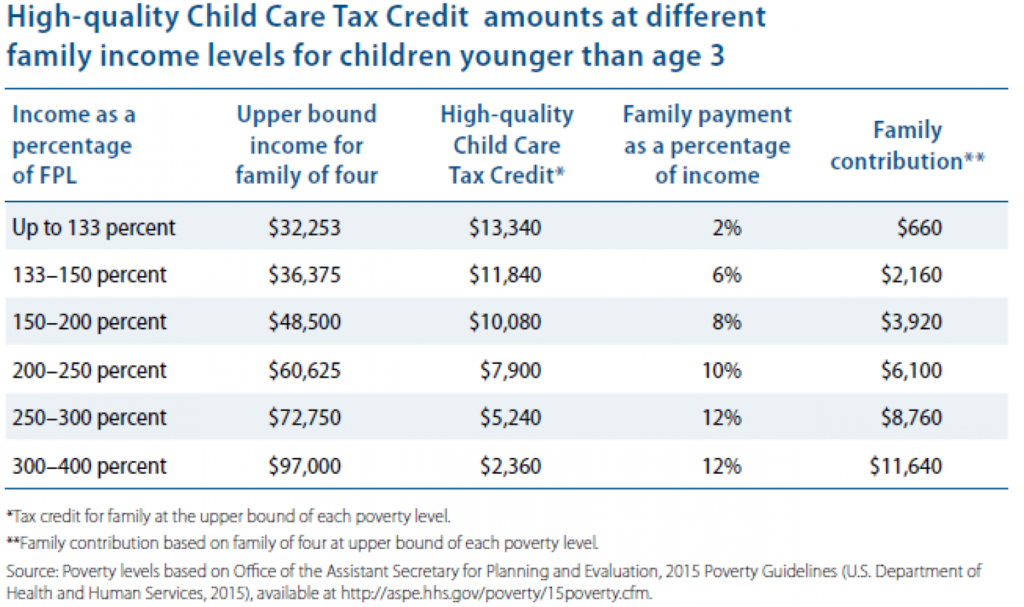

The amount of the Child Care Tax Credit varies based on your income, the number of qualifying children, and your child care expenses. The credit is a percentage of your eligible expenses, up to certain limits. As of 2021, the maximum credit percentage is 35%, and the maximum eligible expenses are $3000 for one child or $6000 for two or more children.

Let’s look at an example to understand how the credit works. Suppose you have one child under the age of 13 and incurred $5000 in child care expenses. If your income is below the threshold, you could potentially receive a credit of $1750 (35% of $5000) to offset your tax liability.

It’s important to note that the Child Care Tax Credit is non-refundable. This means the credit can reduce your tax liability to zero, but any excess credit will not result in a refund. However, there is a separate provision called the Additional Child Tax Credit that may allow for a refund in certain situations.

Frequently Asked Questions

Q: Can I receive the Child Care Tax Credit if my child attends a public school or is homeschooled?

A: Yes, as long as your child is under the age of 13 and you meet the other eligibility requirements, you can claim the tax credit regardless of the type of education your child receives.

Q: Can I claim the Child Care Tax Credit if I receive employer-provided child care benefits?

A: Yes, you can still claim the tax credit for expenses not covered by your employer-provided benefits. However, you must subtract the amount of these benefits from your total eligible expenses.

Q: Can I claim the Child Care Tax Credit if I have a part-time job?

A: Yes, as long as you have earned income and meet the other requirements, you can claim the tax credit even if you have a part-time job.

Q: Is the Child Care Tax Credit available for overnight child care?

A: No, expenses for overnight care, such as sleepaway camps, do not qualify for the Child Care Tax Credit. The care must be provided during the day.

Final Thoughts

The Child Care Tax Credit can be a valuable resource for working parents facing the high costs of child care. By understanding the eligibility criteria and following the proper steps to claim the credit, you can potentially reduce your tax burden and receive much-needed financial relief. Be sure to consult with a tax professional or refer to the IRS guidelines for specific details related to your situation. Remember, every dollar saved through the Child Care Tax Credit helps to support your family’s well-being and financial stability.