Child Tax Credit 2022 Georgia: Everything You Need to Know

If you’re a resident of Georgia and have children, you may be wondering about the child tax credit for 2022. The child tax credit is a financial benefit provided by the government to help families with the cost of raising children. In this article, we’ll explore everything you need to know about the child tax credit in Georgia for 2022.

What is the Child Tax Credit?

The child tax credit is a tax benefit that provides financial assistance to parents or guardians who have qualifying dependents. It is designed to help ease the financial burden of raising children and provide support to families. The credit is provided by the Internal Revenue Service (IRS) and can help offset the cost of child-related expenses such as education, healthcare, and childcare.

Child Tax Credit Changes in 2022

Increased Credit Amount

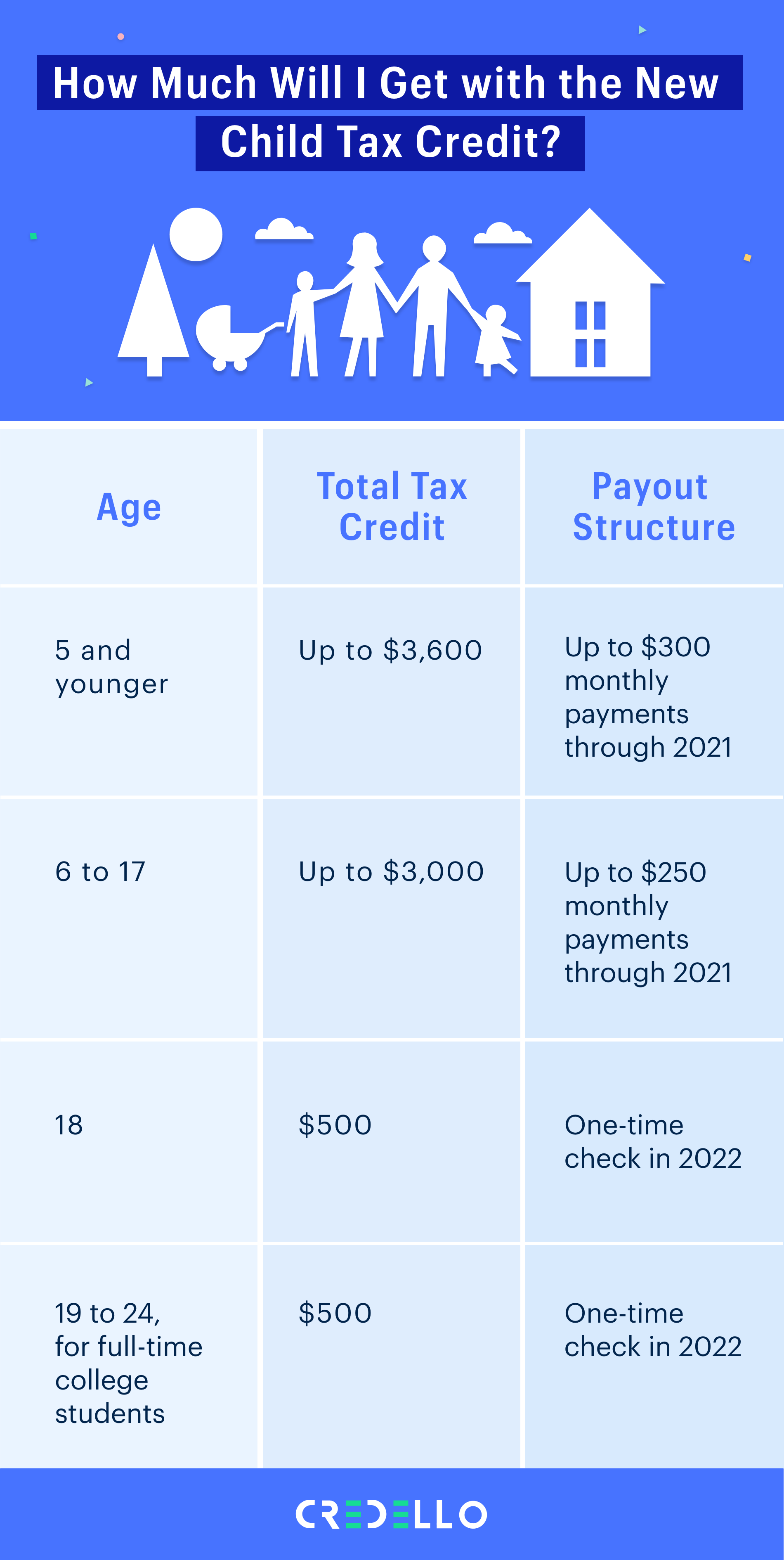

One of the significant changes to the child tax credit in 2022 is the increased credit amount. The previous maximum credit amount of $2,000 per child has been increased to $3,000 per child for children between the ages of 6 and 17. For children under the age of 6, the credit has been increased to $3,600. These increased amounts can provide substantial financial relief for eligible families.

Expanded Age Eligibility

Another change is the expanded age eligibility for the child tax credit. In previous years, the credit was only available for children under the age of 17. However, in 2022, the age limit has been raised to include children up to the age of 18. This extension allows families with older children to continue benefiting from the tax credit.

Advanced Payments

One of the most significant changes to the child tax credit is the introduction of advanced payments. Starting in 2022, eligible families can receive a portion of their child tax credit in advance on a monthly basis. These advanced payments can help provide immediate financial support to families and assist with the cost of raising children throughout the year.

Who is Eligible for the Child Tax Credit?

To qualify for the child tax credit in Georgia, you must meet certain criteria. Here are the eligibility requirements:

Income Thresholds

The child tax credit is phased out for higher-income households. For single filers, the phase-out begins at an adjusted gross income (AGI) of $200,000, and for married couples filing jointly, the phase-out begins at an AGI of $400,000. If your income exceeds these thresholds, the amount of the credit will be reduced.

Child Qualifications

The child must meet certain qualifications to be considered eligible for the tax credit. The child must be under the age of 18 at the end of the tax year and must be your dependent. Additionally, the child must have a valid Social Security number and must have lived with you for more than half of the tax year.

Relationship and Residency Requirements

To claim the child tax credit, you must have a qualifying relationship with the child. This includes being the child’s parent, step-parent, foster parent, or adoptive parent. Additionally, the child must be a U.S. citizen, national, or resident alien.

How to Claim the Child Tax Credit in Georgia

To claim the child tax credit in Georgia, you will need to file your tax return and include the necessary documentation. You will need to provide information about your qualifying child, including their Social Security number. It’s essential to keep accurate records and documentation to support your claim.

Frequently Asked Questions

Q: Can I receive the child tax credit if I am not employed?

Yes, you can still receive the child tax credit even if you are not employed. The credit is available to eligible parents or guardians, regardless of their employment status. However, you must still meet the income and other eligibility requirements to qualify for the credit.

Q: Are the advanced payments of the child tax credit taxable?

No, the advanced payments of the child tax credit are not taxable. They do not need to be reported as income and do not affect your tax liability in the future. However, it’s essential to update your information with the IRS if your circumstances change to ensure you receive the correct amount of the credit.

Q: Can I claim the child tax credit if my child has a disability?

Yes, you can claim the child tax credit if your child has a disability. The child tax credit includes an additional credit called the Additional Child Tax Credit, which is available for families with qualifying disabled children. This additional credit can provide further financial assistance to eligible families.

Final Thoughts

The child tax credit in Georgia for 2022 can be a valuable financial resource for eligible families. The increased credit amount, expanded age eligibility, and advanced payments can help ease the financial burden of raising children. It’s important to understand the eligibility requirements and stay up to date with any changes to ensure you can take full advantage of the available benefits. By claiming the child tax credit, you can provide essential support to your family and ensure the well-being and development of your children.