Child tax credit is a valuable government benefit that helps families with the cost of raising children. In Tennessee, the child tax credit for 2022 provides financial assistance to eligible families, giving them a much-needed boost to their household income. In this article, we will explore the details of the child tax credit in Tennessee for 2022, including eligibility criteria, payment amounts, and how to claim the credit. We will also address some frequently asked questions and offer some final thoughts on this important financial support.

The Child Tax Credit in Tennessee for 2022

Eligibility Criteria

To be eligible for the child tax credit in Tennessee for 2022, families must meet certain requirements. Here are the key eligibility criteria:

1. Age: The child must be under the age of 17 at the end of the tax year for which the credit is being claimed.

2. Relationship: The child must be your biological child, adopted child, stepchild, or foster child. In some cases, grandchildren, siblings, or nieces and nephews may also qualify.

3. Residency: The child must have a valid Social Security number and have lived with you for more than half of the tax year.

4. Income Limits: The child tax credit is phased out for higher-income families. For 2022, the phaseout begins at a modified adjusted gross income (MAGI) of $75,000 for single filers and $150,000 for joint filers.

Payment Amounts

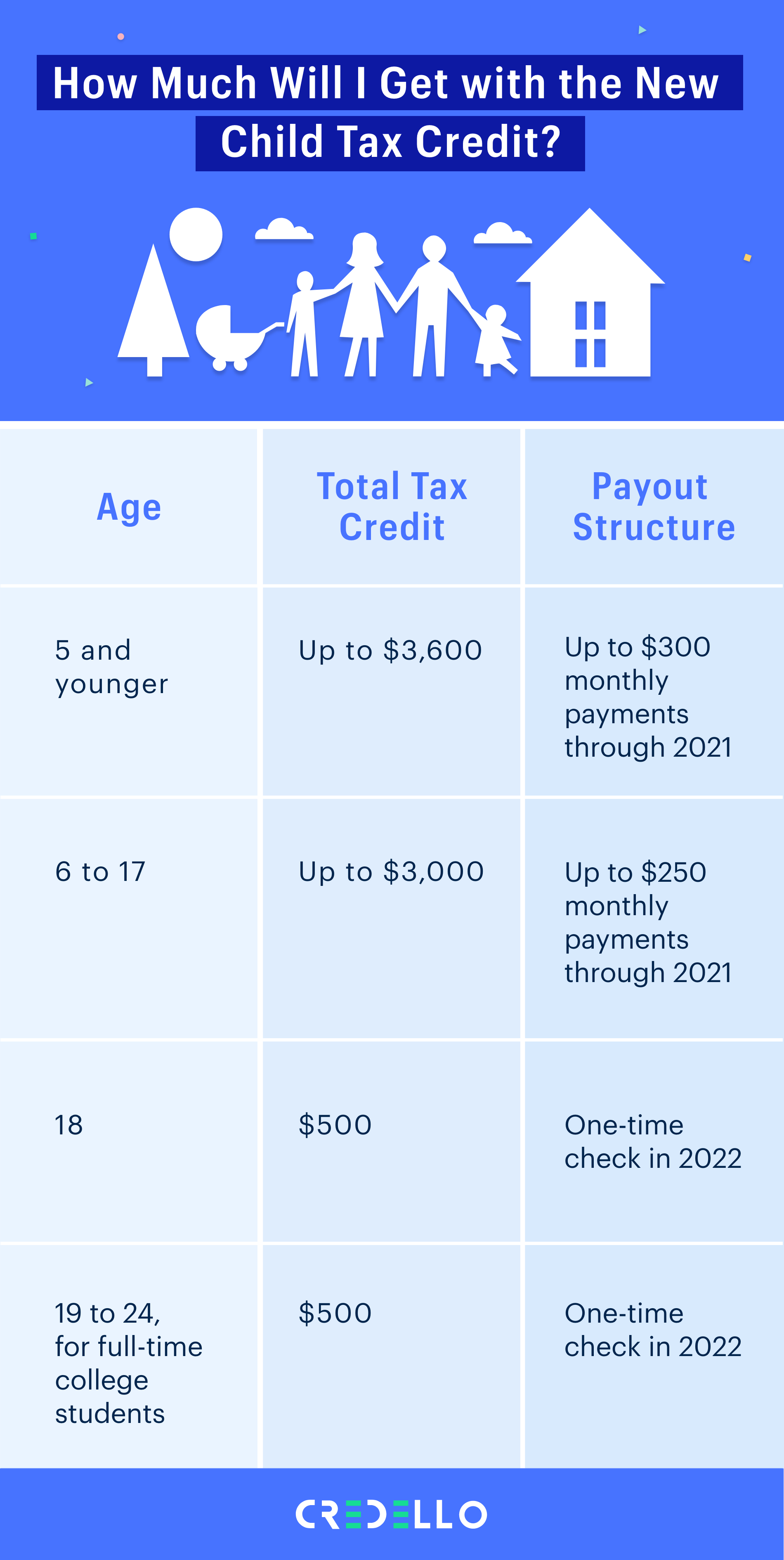

The child tax credit amount for 2022 in Tennessee is up to $3,600 per child under the age of 6 and up to $3,000 per child between the ages of 6 and 17. This credit is fully refundable, meaning that even if the amount exceeds your tax liability, you can receive the difference as a refund.

It’s important to note that the child tax credit is subject to income limits. The higher-income families may receive a reduced credit amount or may not be eligible for the credit at all. The phaseout begins at $75,000 for single filers and $150,000 for joint filers.

Claiming the Credit

To claim the child tax credit for 2022 in Tennessee, you will need to include the necessary information on your federal tax return. Here are the steps to follow:

1. Provide the necessary information: On your tax return, you will need to provide the names, ages, and Social Security numbers of all qualifying children.

2. Determine the credit amount: Calculate the credit amount based on the age of each child and your total income. IRS Publication 972 provides detailed instructions for determining the credit amount.

3. Include the credit on your tax return: Report the calculated credit amount on your federal tax return. The credit will be used to offset your tax liability or refunded to you if it exceeds your tax liability.

Frequently Asked Questions

Q: Will I receive the child tax credit in monthly payments or as a lump sum?

A: Starting in 2022, eligible families can choose to receive the child tax credit in monthly payments from July to December or as a lump sum when they file their tax return. The monthly payment option provides a steady stream of income throughout the year, while the lump sum option allows families to receive the full credit amount at once.

Q: Do I need to file a tax return to claim the child tax credit?

A: Yes, to claim the child tax credit, you must file a federal tax return. The credit cannot be claimed if you do not file a tax return.

Q: Can I claim the child tax credit if I am not the child’s parent?

A: In some cases, non-parents may be eligible to claim the child tax credit if they meet certain criteria. This includes situations where the child’s parents are unable to claim the credit or if the child is considered a qualifying child for multiple taxpayers.

Final Thoughts

The child tax credit in Tennessee for 2022 provides much-needed financial assistance to eligible families. By understanding the eligibility criteria, payment amounts, and how to claim the credit, families can take full advantage of this valuable support. Whether you choose to receive the credit in monthly payments or as a lump sum, the child tax credit can help alleviate the financial burden of raising children and provide a boost to household income. As always, it is advisable to consult with a tax professional or utilize available resources from the IRS to ensure you take full advantage of the child tax credit and maximize its benefits for your family.