**EITC Tables 2017: Understanding and Maximizing Your Tax Credits**

If you’re looking for ways to maximize your tax credits and potentially get a larger refund, then understanding the EITC (Earned Income Tax Credit) tables for 2017 is essential. The EITC is a refundable tax credit designed to assist low and moderate-income individuals and families. By referring to the EITC tables, you can determine the amount of credit you are eligible for based on your income, filing status, and the number of qualifying children you have.

**What are the EITC tables for 2017?**

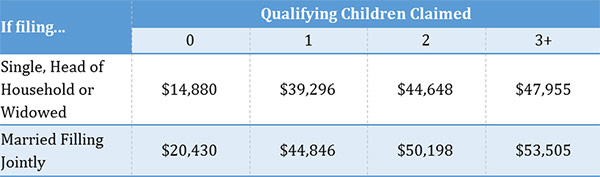

The EITC tables for 2017 are used to calculate the amount of credit you can claim on your tax return. These tables provide guidelines for determining your eligibility and the maximum credit you may receive based on your income and family size. They are organized by filing status and the number of qualifying children you have.

**Understanding the EITC tables**

The EITC tables are divided into sections based on your filing status – single, married filing jointly, head of household, etc. Within each section, there are different columns that correspond to the number of qualifying children you have. The tables provide the maximum credit amounts at various income levels. To find the amount of credit you are eligible for, you need to find the intersection of your income and family size.

Let’s take a look at an example to illustrate how the tables work. Suppose you are a single individual with one qualifying child. According to the EITC tables for 2017, if your income falls between $15,010 and $39,617, you may be eligible for a maximum credit of $3,400. If your income is below $15,010, your credit amount will be lower, and if your income exceeds $39,617, you will not qualify for the credit.

It’s important to note that the EITC is a refundable credit, meaning that if the amount of credit you qualify for exceeds the amount of taxes you owe, you can receive the difference as a tax refund. This makes the EITC an incredibly valuable credit for those who qualify.

**Maximizing your EITC**

Now that you understand the basics of the EITC tables for 2017, let’s explore some strategies to maximize your EITC and potentially get a larger refund.

**1. Ensure you meet the eligibility criteria**

To qualify for the EITC, you must meet certain income and filing status requirements. Additionally, you must have a valid Social Security Number and meet specific rules regarding age, residency, and relationship with the qualifying child. Familiarize yourself with the eligibility criteria to ensure you meet all the requirements.

**2. Accurately calculate your income**

When determining your eligibility, it’s crucial to calculate your income correctly. This includes not only your wages but also any additional income you may have, such as self-employment earnings or unemployment compensation. Inaccurate income calculations can result in an incorrect credit amount.

**3. Keep track of changes in your family size**

The number of qualifying children you have can significantly impact the amount of credit you are eligible for. If your family size changes during the year, such as the birth of a child, adoption, or gaining custody of a child, make sure to update your information accordingly when filing your tax return. Failing to do so may result in a lower credit amount.

**4. Claim missed credits from previous years**

If you didn’t claim the EITC in previous years but believe you were eligible, you may be able to file an amended return to claim those missed credits. The IRS allows you to amend a return for up to three years after the due date or two years after you paid the tax, whichever is later. Make sure to review your past returns and consult with a tax professional to determine if you can claim any missed credits.

**Frequently Asked Questions**

Frequently Asked Questions

Q: Can I claim the EITC if I’m self-employed?

Yes, self-employed individuals can claim the EITC if they meet the income and other eligibility criteria. It’s important to accurately report your self-employment income and expenses on your tax return to calculate the EITC correctly.

Q: Does the EITC reduce my refund?

No, the EITC is a refundable credit, which means it can increase your refund or offset any tax liability you may have. If the amount of credit you qualify for exceeds the taxes you owe, you will receive the difference as a refund.

Q: Can I claim the EITC if I’m a student?

Depending on your age, income level, and other factors, you may be eligible for the EITC as a student. As long as you meet the income and eligibility requirements, you can claim the credit.

Final Thoughts

Understanding the EITC tables for 2017 is crucial if you want to maximize your tax credits and potentially get a larger refund. By referring to the tables and following the strategies discussed, you can ensure that you are claiming the maximum credit you are eligible for. Remember to review the eligibility criteria, accurately calculate your income, and keep track of changes in your family size. If you have any questions or need further assistance, consult with a tax professional who can provide personalized advice based on your specific situation.