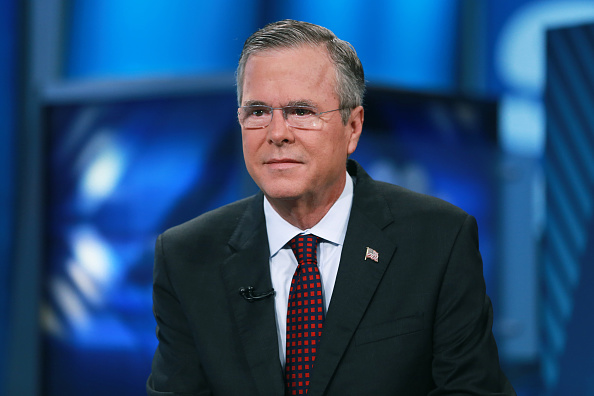

Jeb Bush Tax Plan 2016

**Answer:** Jeb Bush’s tax plan for 2016 aimed to simplify the tax code, reduce tax rates, and stimulate economic growth. It proposed a significant overhaul of the current tax system to make it fairer, more efficient, and beneficial for all Americans. Let’s take a closer look at Jeb Bush’s tax plan and its key components.

Tax Simplification and Fairness:

Lower Tax Rates

Jeb Bush’s tax plan aimed to simplify the tax code by reducing the number of tax brackets from seven to just three. The proposed tax brackets were as follows:

– 10% for individuals earning up to $37,500 and married couples earning up to $75,000

– 25% for individuals earning between $37,501 and $250,000, and married couples earning between $75,001 and $500,000

– 28% for individuals earning above $250,000, and married couples earning above $500,000

By reducing the number of tax brackets and lowering tax rates, Bush intended to provide relief to middle-class Americans and encourage economic growth.

Elimination of Deductions and Loopholes

Jeb Bush’s tax plan sought to eliminate various deductions and loopholes in the tax code. This move aimed to streamline the system, reduce complexity, and ensure that everyone pays their fair share of taxes. While some popular deductions and exemptions were proposed to be eliminated, the plan also included an increase in the standard deduction to protect lower-income households from higher tax burdens.

Corporate Tax Reform

Bush’s tax plan also included reforms to the corporate tax system. The proposed plan aimed to reduce the corporate tax rate from 35% to 20%, making it more competitive on a global scale. Additionally, the plan proposed moving to a territorial tax system, where corporations are taxed only on income earned within the United States. This change was intended to encourage businesses to invest and create jobs within the country.

Capital Gains Tax Reform

Jeb Bush’s tax plan proposed significant changes to the capital gains tax system. The plan suggested replacing the current system of multiple tax rates on capital gains with a single 20% rate. This change aimed to simplify the tax code and incentivize investment and entrepreneurship.

Stimulating Economic Growth:

Expensing of Business Investments

Jeb Bush’s tax plan included a provision for immediate deduction of capital expenses for businesses, allowing them to deduct investments in equipment, machinery, and other assets in the year of purchase rather than depreciating them over time. This measure was intended to incentivize companies to invest in their businesses, stimulate economic growth, and create jobs.

Repeal of the Estate Tax

The plan also called for the repeal of the estate tax, which is often referred to as the “death tax.” According to Jeb Bush, the estate tax penalizes success and stifles economic growth by imposing a substantial tax on inherited wealth. The repeal aimed to provide relief to families and small businesses and promote the transfer of wealth to future generations.

Frequently Asked Questions:

Will the tax plan benefit the middle class?

Yes, Jeb Bush’s tax plan aimed to provide relief to the middle class by simplifying the tax code and lowering tax rates. By reducing the number of tax brackets and increasing the standard deduction, the plan intended to reduce the tax burden on middle-class Americans.

How would the tax plan impact corporations?

Jeb Bush’s tax plan proposed significant reforms to the corporate tax system. The plan aimed to reduce the corporate tax rate to 20% and transition to a territorial tax system. These changes were intended to make the United States a more attractive destination for businesses, encourage investment, and stimulate economic growth.

What are the criticisms of the tax plan?

Critics of Jeb Bush’s tax plan argue that the proposed tax cuts would disproportionately benefit the wealthy. They argue that reducing tax rates for the highest income earners and eliminating deductions and exemptions could result in a larger tax burden for lower-income households. Critics also express concerns about the potential impact on government revenue and the national debt.

Final Thoughts:

Jeb Bush’s tax plan for 2016 aimed to simplify the tax code, reduce tax rates, and stimulate economic growth. While the plan had its supporters who believed it would provide relief to the middle class and promote investment and entrepreneurship, it also faced criticisms regarding its potential impact on income inequality and government revenue. As with any tax proposal, it is essential to consider all perspectives and evaluate the potential consequences before making a judgment.