Optimizing Your Tax Structure: Exploring Jerry Brown’s Flat Tax Proposal

**Jerry Brown’s Flat Tax Proposal**: A Breakdown of its Potential Impact and Controversies

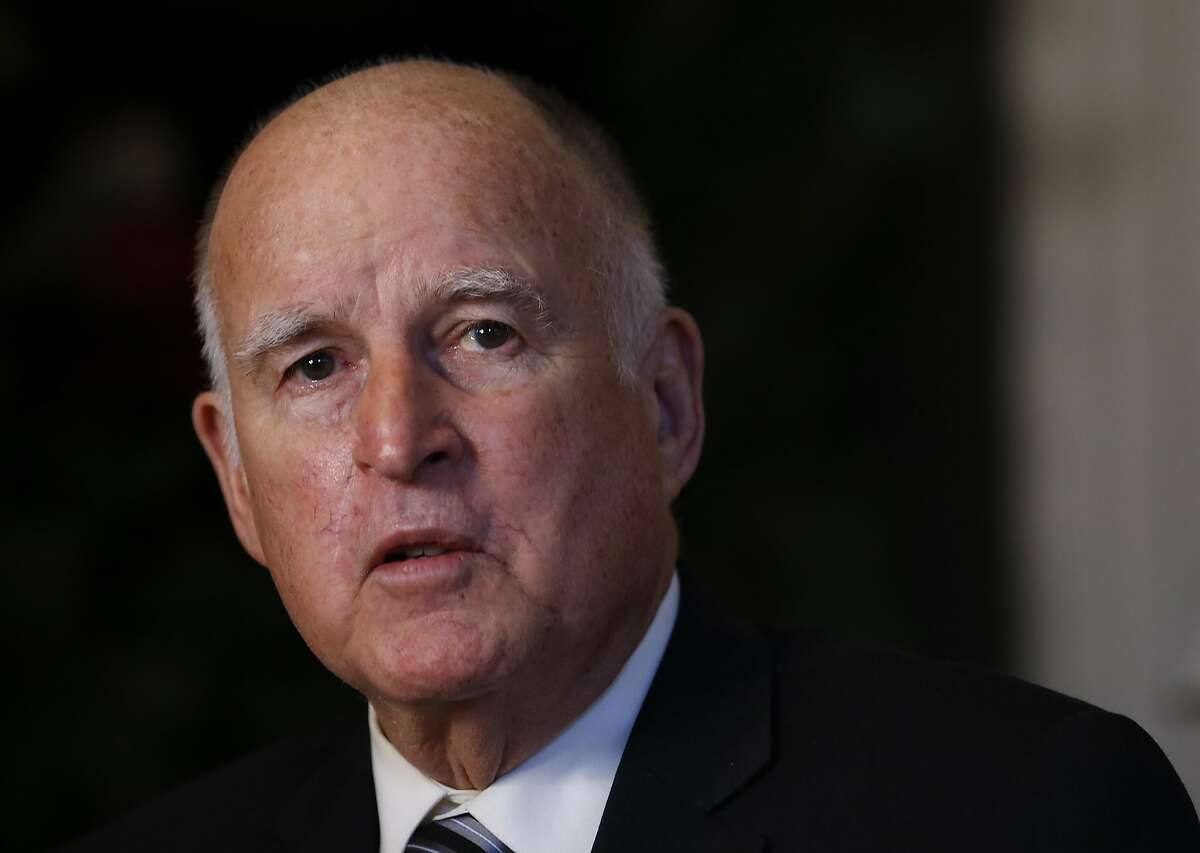

Jerry Brown, the former governor of California, has recently put forth a bold and controversial proposal to implement a flat tax system in the state. Although many arguments have been made both for and against this idea, it is crucial to delve deeper and understand the potential consequences and benefits such a tax structure could bring. In this article, we will explore Jerry Brown’s flat tax proposal and examine its various aspects in detail.

**The Basics of Jerry Brown’s Flat Tax Proposal**

Under Jerry Brown’s flat tax proposal, the current progressive income tax system would be replaced by a standardized tax rate for all individuals, regardless of income level. This means that everyone, regardless of whether they are a low-wage earner or a high-income earner, would be subject to the same tax rate.

Supporters of this proposal argue that implementing a flat tax would simplify the tax filing process and promote fairness, as everyone would be contributing their fair share. Additionally, they contend that it would incentivize economic growth and stimulate investment, as high-income earners would not be penalized with higher tax rates.

However, critics raise several concerns about this approach. One major criticism is that a flat tax system may disproportionately burden low-income individuals and exacerbate income inequality. They argue that the tax burden should be distributed proportionally to one’s ability to pay, which is better achieved through a progressive tax system. Moreover, opponents argue that a flat tax system could lead to a decrease in tax revenue, potentially impacting public services and programs.

**Potential Benefits and Drawbacks of Jerry Brown’s Flat Tax Proposal**

Let’s explore the potential benefits and drawbacks of Jerry Brown’s flat tax proposal in greater detail.

**Benefits of a Flat Tax System**

1. **Simplicity**: One of the key advantages of a flat tax system is its simplicity. With a single tax rate, taxpayers would not have to navigate complex tax brackets and calculations, making the filing process easier and faster.

2. **Fairness**: Proponents of a flat tax argue that it promotes fairness by treating everyone equally. They believe that taxing all individuals at the same rate encourages a sense of shared responsibility and fiscal discipline.

3. **Economic Growth**: Advocates for a flat tax system claim that it would stimulate economic growth by incentivizing investment and entrepreneurship. They argue that lower tax rates for high-income earners would encourage them to invest in businesses and create job opportunities.

**Drawbacks of a Flat Tax System**

1. **Income Inequality**: One of the main criticisms of a flat tax system is its potential to exacerbate income inequality. Critics argue that taxing low-income earners and high-income earners at the same rate does not take into account different levels of wealth and financial security.

2. **Decreased Tax Revenue**: Another concern is the potential decrease in tax revenue. Critics claim that a flat tax system may result in wealthier individuals paying a smaller proportion of their income in taxes, leading to a decrease in funding for public services and social programs.

3. **Burden on Low-Income Earners**: Opponents of a flat tax argue that it could disproportionately burden low-income earners, who rely heavily on every dollar of their income to cover basic necessities. They claim that a progressive tax system, which imposes higher tax rates on higher income brackets, is better suited to address income disparities.

**Frequently Asked Questions**

Can a flat tax system benefit the middle class?

Yes, proponents argue that a flat tax system can benefit the middle class by reducing their tax burden and promoting economic growth. They claim that lower tax rates would free up more disposable income for middle-class individuals and allow them to invest, save, and stimulate the economy.

Would a flat tax system simplify the tax filing process?

Supporters of a flat tax system contend that it would simplify the tax filing process by eliminating complex tax brackets and calculations. With a single tax rate, individuals would only need to calculate their taxable income and apply the standard tax rate, making the process less cumbersome and time-consuming.

How would a flat tax system affect the wealthy?

Under a flat tax system, the wealthy would be subject to the same tax rate as all other individuals. Proponents argue that this would promote fairness and eliminate any perceived advantages or loopholes that the wealthy may currently exploit. However, opponents contend that a flat tax system could result in wealthier individuals paying a smaller proportion of their income in taxes, potentially increasing income inequality.

Final Thoughts

Jerry Brown’s flat tax proposal has ignited a vibrant debate about the fairness and effectiveness of our current tax structure. While it offers potential benefits such as simplicity and fairness, it also raises concerns about its impact on income inequality and tax revenue. As discussions surrounding tax reform continue, it is crucial to consider the multiple perspectives and evaluate the long-term consequences of any proposed changes. Only through a comprehensive analysis can we determine the best path forward in optimizing our tax structure and promoting equitable economic growth.