The Earned Income Credit (EIC) is a tax credit designed to help low-to-moderate-income individuals and families. It can provide a substantial refund and help alleviate financial burdens. However, qualifying for the EIC can be a bit complex. In this article, we’ll dive into who qualifies for the EIC in 2014 and help you determine if you are eligible for this tax credit.

What is the Earned Income Credit?

Before we delve into the qualifications for the EIC in 2014, let’s briefly discuss what the Earned Income Credit actually is. The EIC is a tax credit provided by the Internal Revenue Service (IRS) to help individuals and families with low-to-moderate incomes. Unlike a deduction, which reduces the amount of taxable income, a tax credit directly reduces the amount of taxes owed.

The EIC is refundable, which means that if the credit exceeds the amount of taxes owed, the taxpayer can receive the remaining credit as a refund. This makes the EIC particularly beneficial for individuals and families who have little or no tax liability and may even receive a refund larger than the taxes they paid throughout the year.

Qualifications for the EIC in 2014

To be eligible for the Earned Income Credit in 2014, you must meet certain criteria. These criteria include:

1. Earned Income and Adjusted Gross Income (AGI) Limits

The first qualification for the EIC is based on your earned income and adjusted gross income (AGI). For example, in 2014, if you were single with no qualifying children, your earned income and AGI must be less than $14,590 to qualify for the credit. The income thresholds increase for individuals with qualifying children or who are married filing jointly.

2. Filing Status

Your filing status also plays a role in determining your eligibility for the EIC. In most cases, you must file as single, head of household, or married filing jointly to qualify. However, there are some exceptions, such as individuals who are married but living apart from their spouse or those who are widowed and meet certain criteria.

3. Qualifying Children

Qualifying children are an essential component of determining EIC eligibility. You must have a qualifying child who meets specific criteria in order to claim the EIC. The child must be your son, daughter, stepchild, adopted child, foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of any of them. Additionally, the child must meet age, relationship, residency, and joint return requirements.

4. Investment Income Limit

Another qualification for the EIC is the investment income limit. In 2014, your investment income must be $3,350 or less to be eligible for the credit. Investment income includes items such as interest, dividends, and capital gains.

Frequently Asked Questions

1. Can I claim the EIC if I have no children?

Yes, you can claim the EIC even if you have no qualifying children. However, the income limits are lower for individuals without qualifying children. In 2014, your earned income and AGI must be less than $14,590 for singles without qualifying children.

2. What if I am self-employed?

Self-employed individuals can still qualify for the EIC. However, they must meet the same eligibility requirements as individuals who earn income from wages or salaries. It’s important to accurately report your self-employment income and expenses to determine your eligibility for the EIC.

3. Can I claim the EIC if I am a full-time student?

If you are a full-time student under the age of 24, you cannot claim the EIC unless you have a qualifying child or meet the criteria for being permanently and totally disabled.

4. How do I claim the EIC?

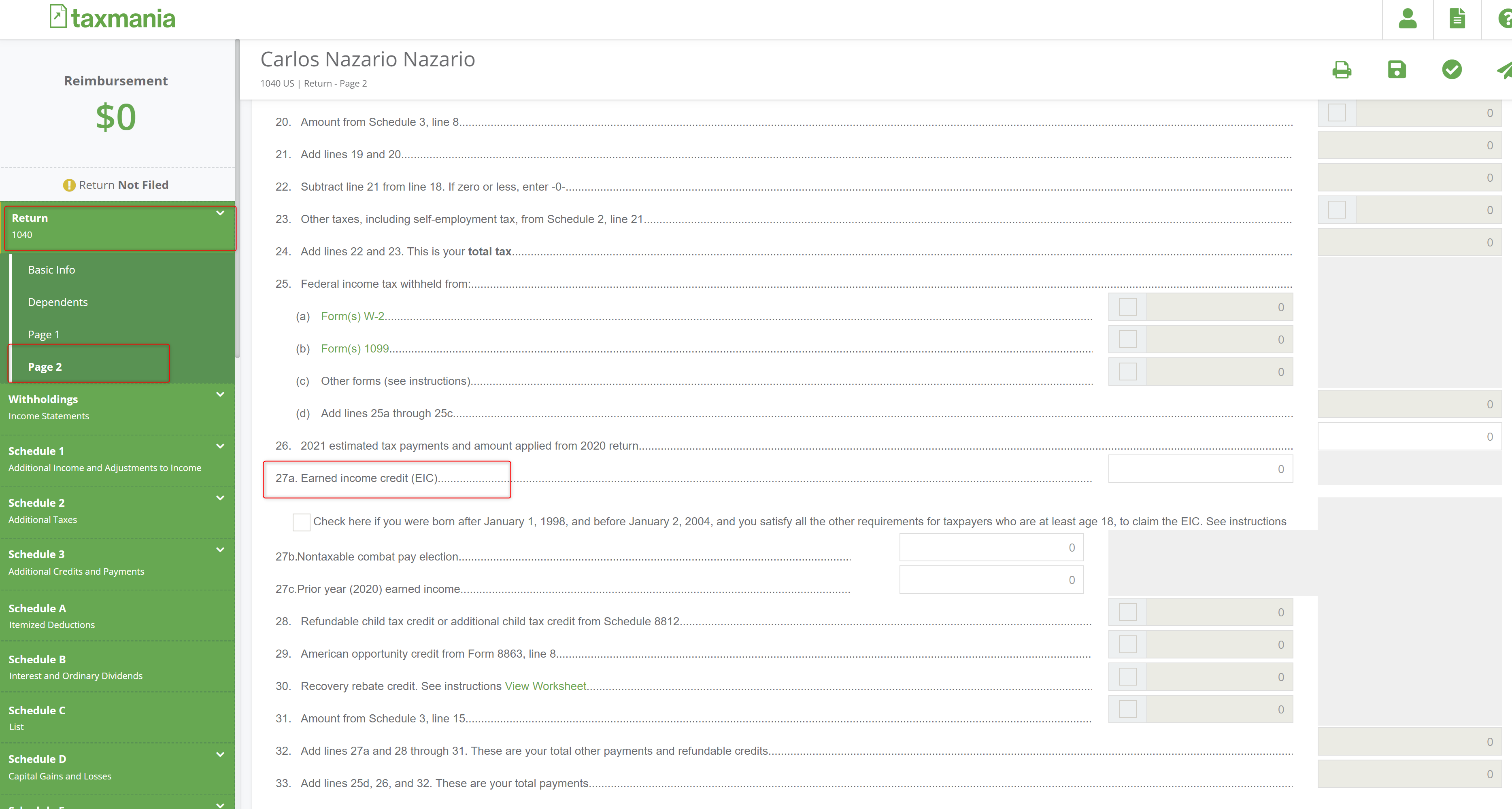

To claim the EIC, you must file a tax return and complete Schedule EIC. The IRS will calculate the credit based on your income and family size. If you are eligible for the EIC, you must file a tax return, even if you are not normally required to do so.

Final Thoughts

The Earned Income Credit can be a helpful resource for individuals and families with low-to-moderate incomes. If you meet the qualifications for the EIC in 2014, claiming this tax credit can provide a significant refund and help improve your financial situation. Be sure to carefully review the guidelines and consult with a tax professional if you have any questions or need assistance with your tax return.

In conclusion, understanding who qualifies for the EIC in 2014 is important to ensure you receive the tax benefits you are eligible for. By meeting the income and filing status requirements, having qualifying children, staying within the investment income limit, and accurately claiming the credit on your tax return, you can take advantage of the benefits provided by the Earned Income Credit.