According to the IRS, the Child Tax Credit is a valuable tax benefit that aims to provide financial support to families with qualifying children. If you reside in New York and are wondering what the Child Tax Credit 2022 has in store for you, you’ve come to the right place. In this article, we will delve into the details of the Child Tax Credit, how it applies to New York residents, and what changes can be expected in 2022. Let’s explore!

Understanding the Child Tax Credit

The Child Tax Credit is a tax benefit that allows eligible families to reduce their federal income tax liability by a specific amount for each qualifying child under the age of 17. It is important to note that the credit is not a deduction but rather a credit that directly reduces the amount of tax owed. In some cases, it can even result in a refund if the credit exceeds the taxes owed.

Eligibility requirements for the Child Tax Credit

To qualify for the Child Tax Credit, you must meet certain requirements:

1. **Age**: The child must be under the age of 17 at the end of the tax year.

2. **Relationship**: The child must be your son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, or a descendant of any of them.

3. **Residency**: The child must have lived with you for more than half of the tax year.

4. **Support**: The child must not have provided more than half of their own financial support during the tax year.

5. **Citizenship**: The child must be a U.S. citizen, a U.S. national, or a U.S. resident alien.

Changes to the Child Tax Credit in 2022

For the year 2022, the Child Tax Credit has undergone a few changes, particularly due to the American Rescue Plan Act passed by Congress. Here are the key changes:

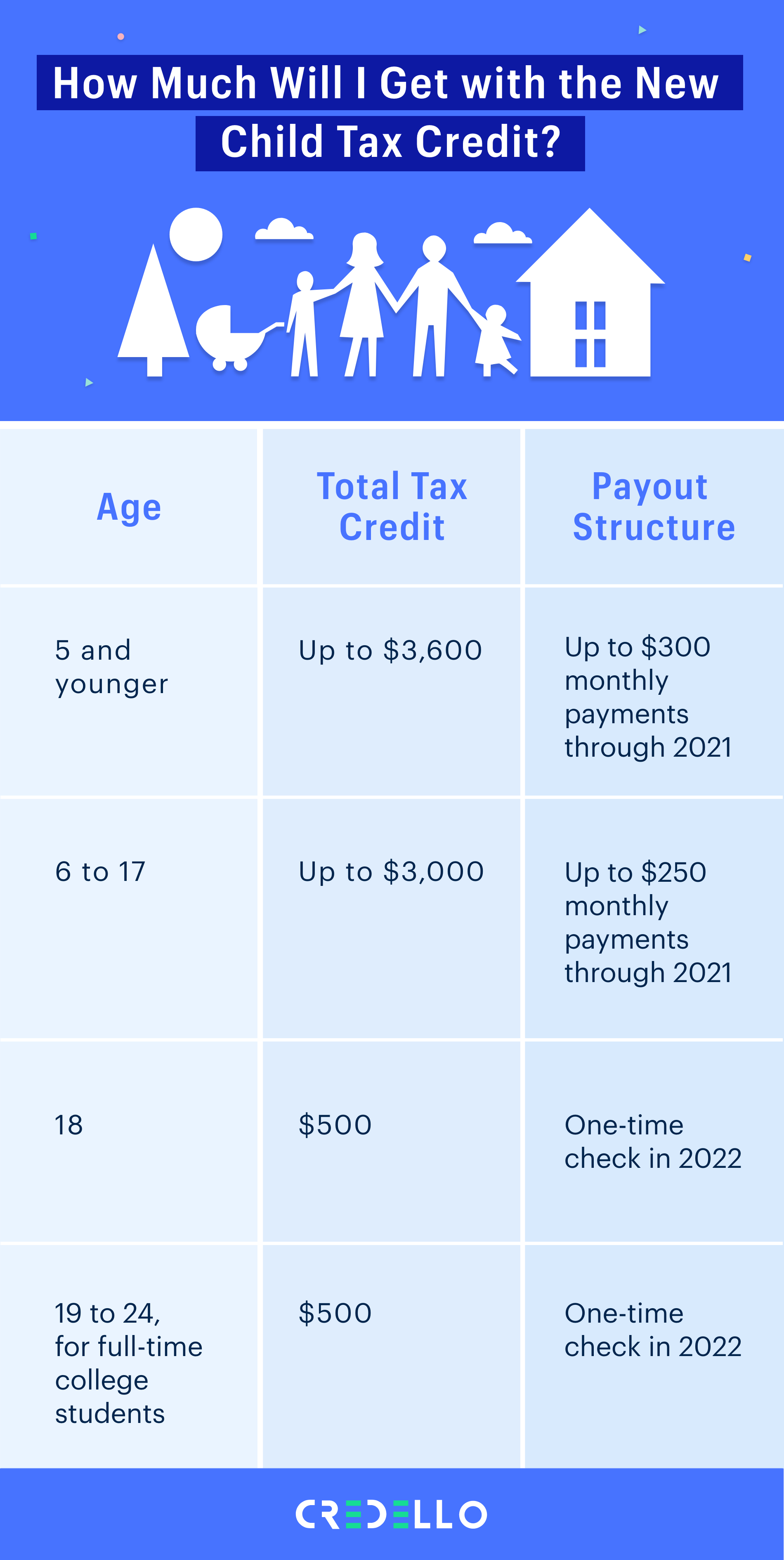

1. **Increased credit amount**: The maximum Child Tax Credit for 2022 has been increased to $3,000 per qualifying child. For children under the age of 6, the credit has been further increased to $3,600.

2. **Age limit extension**: The age limit for qualifying children has been raised to 18 for 2022, allowing families to claim the credit for older children who meet the other eligibility requirements.

3. **Advance payments**: One significant change is the introduction of advance payments of the Child Tax Credit. Starting in July 2022, eligible families began receiving monthly payments of up to $300 per child as an advance on their 2022 credit.

4. **Phase-out thresholds**: Higher-income families may experience a phase-out of the credit. For 2022, the phase-out begins at $75,000 for single filers, $112,500 for Head of Household filers, and $150,000 for married filing jointly filers.

Frequently Asked Questions

1. Can I claim the Child Tax Credit if I live in New York?

Yes, residents of New York are eligible to claim the Child Tax Credit, provided they meet the necessary requirements outlined by the IRS.

2. How do I claim the Child Tax Credit in New York?

To claim the Child Tax Credit, you will need to fill out Form 1040 or 1040-SR and include the relevant information about your qualifying child. Make sure to follow the instructions provided by the IRS and include any additional documentation required.

3. What if I have more than one qualifying child?

If you have more than one qualifying child, you can claim the Child Tax Credit for each child, as long as they meet the eligibility requirements. The credit amount will be multiplied by the number of qualifying children.

4. Do I need to have earned income to claim the Child Tax Credit?

While earned income can affect the amount of the credit, you do not necessarily need to have earned income to claim the Child Tax Credit. However, you must have some form of taxable income to qualify for the credit.

5. Can I receive advance payments of the Child Tax Credit if I live in New York?

Yes, New York residents are eligible to receive advance payments of the Child Tax Credit, just like residents of other states. These monthly payments provide financial assistance throughout the year, rather than waiting until tax filing season.

Final Thoughts

The Child Tax Credit can be an invaluable support for families, particularly in challenging times. As a New York resident, understanding the eligibility requirements and changes to the credit in 2022 can help you make the most of this beneficial tax benefit. Make sure to consult with a qualified tax professional or utilize reputable tax software to ensure accurate reporting and maximize your tax savings. Remember, every dollar saved can make a significant difference in providing for your family’s well-being and financial security.