The Child Tax Credit (CTC) in California is a financial benefit provided to eligible families to help support the costs of raising children. In 2022, there are several important updates and changes to the CTC that families need to be aware of. In this article, we will discuss the Child Tax Credit 2022 in California and provide detailed information on how it works, who is eligible, how to claim it, and more.

What is the Child Tax Credit?

The Child Tax Credit is a tax benefit offered by the federal and state governments to assist families with the costs of raising children. It is a direct payment made to eligible families that can help cover expenses such as childcare, education, and healthcare. The Child Tax Credit aims to provide financial support to families and reduce the financial burden of parenting.

How does the Child Tax Credit work in 2022?

In 2022, the Child Tax Credit has undergone several changes to provide additional financial assistance to eligible families. The American Rescue Plan Act (ARPA) expanded the credit and made it available to more families. Here are the key details of the 2022 Child Tax Credit:

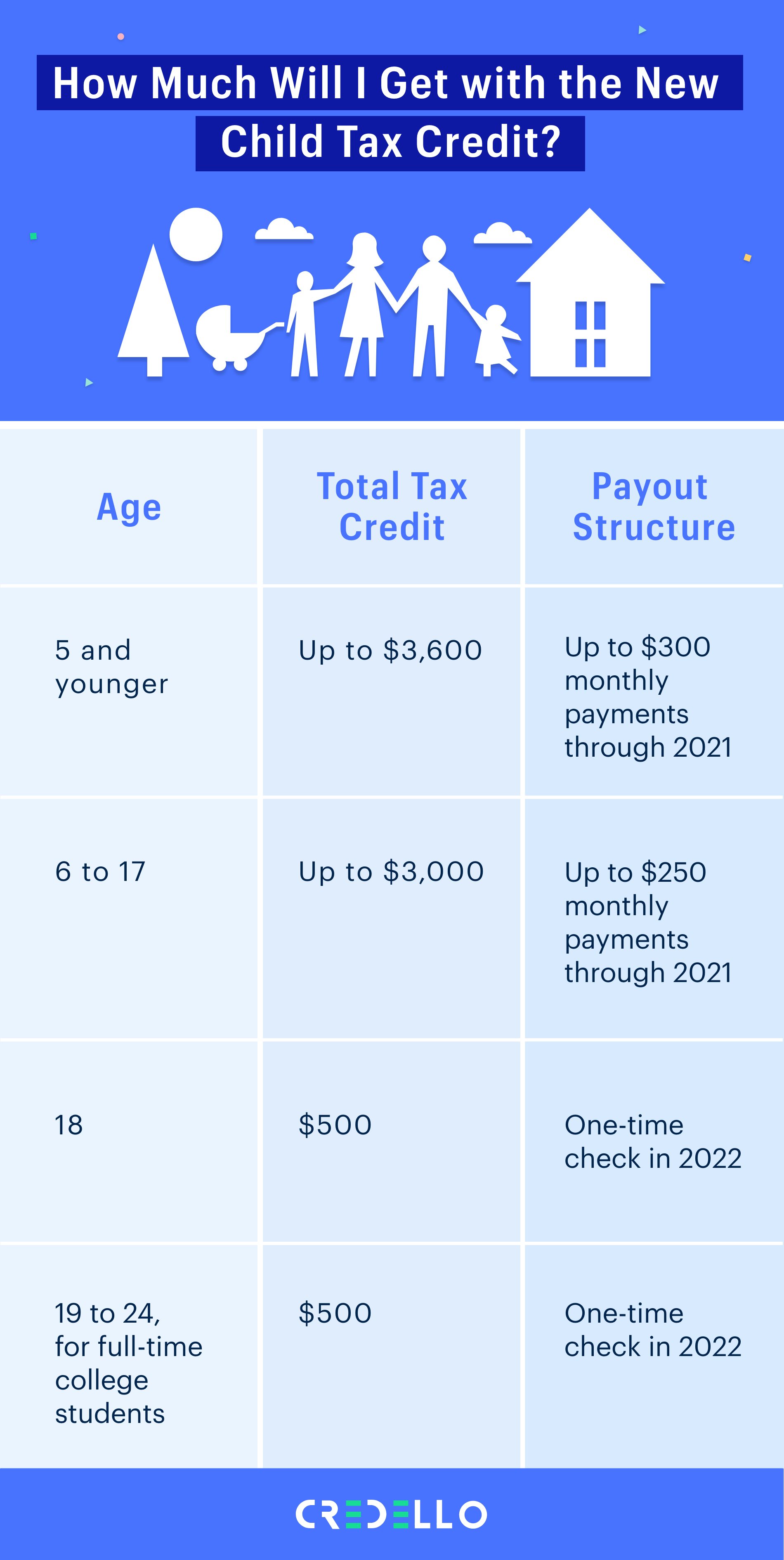

1. Increased credit amount: The maximum credit amount has been increased to $3,000 per child aged 6 to 17 and $3,600 per child under the age of 6.

2. Age eligibility: The credit is now available for children up to the age of 17, which was previously limited to children under the age of 17.

3. Monthly payments: Unlike previous years, the Child Tax Credit for 2022 will be distributed in monthly installments from July to December. Eligible families will receive up to $250 per month for each child aged 6 to 17 and up to $300 per month for each child under the age of 6.

4. Expanded income eligibility: The income limits for claiming the Child Tax Credit have been expanded, allowing more families to qualify for the credit. The full credit is available for individuals with a modified adjusted gross income (MAGI) of up to $75,000, heads of household with a MAGI of up to $112,500, and married couples filing jointly with a MAGI of up to $150,000. The credit gradually phases out for higher-income individuals and families.

Who is eligible for the Child Tax Credit in California?

To be eligible for the Child Tax Credit in California, you must meet certain criteria. Here is an overview of the eligibility requirements:

1. Relationship: You must be the parent or legal guardian of the child to claim the credit.

2. Age: The child must be under the age of 18 at the end of the tax year.

3. Residence: Both the child and the claimant must have a valid Social Security number and be a resident of California.

4. Income: Your income must fall within the income limits set by the state. These limits vary based on the number of qualifying children you have.

5. Other tax benefits: You cannot claim the Child Tax Credit if you are already claiming the Dependent Exemption Credit or the California Earned Income Tax Credit.

How to claim the Child Tax Credit in California?

To claim the Child Tax Credit in California, you will need to follow these steps:

1. File your taxes: You must file a state tax return, either through tax software or with the help of a tax professional.

2. Provide necessary information: Make sure to include all the required information about your qualifying children, such as their Social Security numbers and ages.

3. Calculate the credit: Use the appropriate tax forms and calculations to determine the amount of the Child Tax Credit you are eligible for.

4. Claim the credit: Include the Child Tax Credit amount on your state tax return.

5. Submit your return: File your tax return electronically or mail it to the appropriate California tax office.

6. Receive the payment: If you are eligible for the credit, you will receive the payment either as a refund or a reduction in the amount you owe in taxes.

Additional Resources for the Child Tax Credit

If you have further questions or need assistance with the Child Tax Credit, here are some additional resources you can consult:

1. California Franchise Tax Board (FTB): The FTB website provides detailed information on the California Child Tax Credit, including eligibility requirements, forms, and instructions.

2. IRS Child Tax Credit Portal: The Internal Revenue Service (IRS) website offers a dedicated portal where you can access information, resources, and updates regarding the federal Child Tax Credit.

Frequently Asked Questions

1. Can I claim the Child Tax Credit if I have shared custody of my child?

Yes, in cases of shared custody, both parents can claim a portion of the Child Tax Credit for the child. However, both parents must meet the eligibility requirements and cannot claim the full credit for the same child in the same tax year.

2. Will I need to pay back the Child Tax Credit I receive in 2022?

No, the 2022 Child Tax Credit does not have to be repaid. It is a fully refundable tax credit that is designed to provide financial support to eligible families.

3. Can I claim the Child Tax Credit if I am an undocumented immigrant?

Yes, undocumented immigrants can claim the California Child Tax Credit if they meet all other eligibility requirements, except for the requirement to have a valid Social Security number. Undocumented parents can use an Individual Tax Identification Number (ITIN) for their child instead of a Social Security number.

Final Thoughts

In conclusion, the Child Tax Credit in California has been expanded and enhanced for 2022, providing additional financial support to eligible families. If you have children and meet the eligibility criteria, it is crucial to understand the changes to the credit and how to claim it. The Child Tax Credit can help ease the financial burden of raising children and ensure that families have the necessary resources to provide for their children’s well-being. If you have any further questions or need assistance, be sure to consult the resources mentioned above or seek help from a qualified tax professional.