Child Tax Credits: Maximizing Benefits for Your Family

**Are you a parent looking for ways to alleviate the financial burden of raising a child? Child tax credits could be the answer you’re looking for. In this article, we will delve into the world of child tax credits, exploring the various benefits they offer and providing tips on how to maximize them for your family’s financial well-being.**

The Basics of Child Tax Credits

Child tax credits are tax benefits provided by governments to families with dependent children. The goal is to alleviate the financial strain that comes with raising kids and help parents provide a nurturing environment for their children. These credits come in various forms, including refundable and non-refundable credits.

Refundable tax credits allow families to receive a refund even if their tax liability is lower than the credit amount. On the other hand, non-refundable tax credits can reduce a family’s tax liability but do not offer a refund if the credit exceeds their tax burden.

Types of Child Tax Credits

Below are some popular types of child tax credits available:

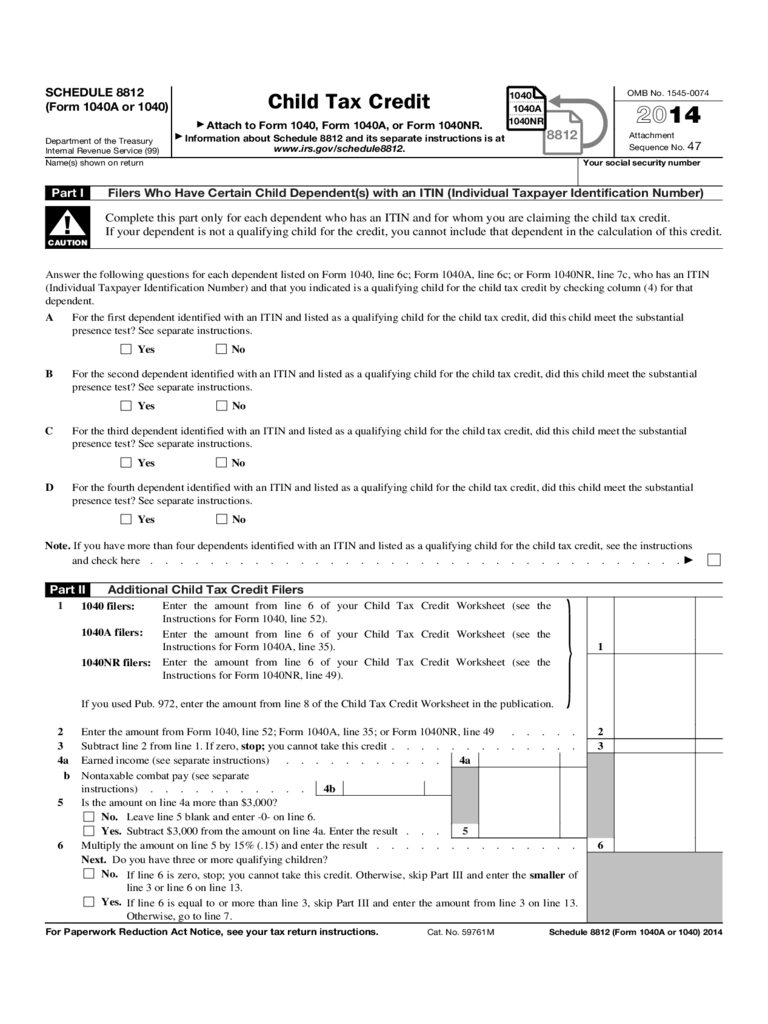

1. Child Tax Credit (CTC)

The Child Tax Credit (CTC) is a federal tax credit offered in many countries. It provides a tax benefit per eligible child under a certain age (usually 17 years old). The credit amount may vary depending on your income level and the number of children you claim for the credit. In some cases, a portion of the CTC may be refundable.

2. Additional Child Tax Credit (ACTC)

The Additional Child Tax Credit (ACTC) is a refundable tax credit that families may qualify for if the CTC exceeds their tax liability. It allows families to receive a refund of up to a certain percentage of their earned income, giving them additional financial support.

3. Child and Dependent Care Credit (CDCC)

The Child and Dependent Care Credit (CDCC) provides a tax credit to offset the costs of childcare or care for a dependent. This credit is especially valuable for working parents or those in school, as it helps to alleviate the financial stress of childcare expenses while they’re away.

Maximizing Child Tax Credits for Your Family

Now that we understand the basics of child tax credits, let’s explore some tips on maximizing the benefits for your family:

1. Stay Informed

The first step to maximizing child tax credits is to stay informed about the eligibility criteria and available credits. Governments often update their tax laws, so keeping up to date with any changes is crucial. Familiarize yourself with the specific requirements for each credit and take advantage of any benefits you qualify for.

2. Claim All Eligible Children

Ensure you claim all eligible children when filing your tax return. Each child you claim for the credits can significantly impact the tax benefits you receive. If you have multiple children, carefully review the requirements and claim all eligible dependents.

3. Understand Income Restrictions

Many child tax credits have income restrictions, meaning they phase out as income levels increase. Familiarize yourself with these restrictions to determine whether you qualify for the maximum benefit. Adjusting your income or exploring ways to reduce your tax liability can help you take full advantage of available credits.

4. Keep Accurate Records and Receipts

Maintaining accurate records and receipts is crucial when claiming child tax credits. Whether it’s medical expenses, childcare costs, or educational expenses, having the necessary documentation can help support your claims and maximize your benefits. Organize your paperwork throughout the year to make tax filing smoother.

5. Consider Professional Help

If navigating the complexities of child tax credits seems daunting, consider seeking professional tax assistance. Tax experts can help you identify all eligible credits, ensure accurate calculations, and maximize your benefits. While there may be a cost associated with professional help, the potential long-term benefits can outweigh the expense.

Frequently Asked Questions

Q: Can I claim child tax credits for my adopted child?

A: Yes, in most cases, you can claim child tax credits for your adopted child. However, there are specific requirements regarding the child’s age, legal status, and dependency, so be sure to review the guidelines and consult with a tax professional for specific advice.

Q: Are child tax credits available to low-income families?

A: Yes, child tax credits are often designed to benefit low-income families. Refundable credits, such as the Additional Child Tax Credit, can provide substantial financial support to families with lower incomes.

Q: Do child tax credits vary from country to country?

A: Yes, child tax credits and benefits vary from country to country. Each jurisdiction has its own set of rules and eligibility criteria, so it’s important to research the specific guidelines for your country or state.

Final Thoughts

Child tax credits provide valuable financial support for families raising children. By understanding the various types of credits available and following the tips outlined in this article, you can make the most of these benefits. Remember to stay informed, claim all eligible children, and keep accurate records to maximize your family’s child tax credits. Explore the possibilities, consult with tax professionals if needed, and ensure your family receives the financial assistance it deserves.