The Child Tax Credit is an important benefit that helps families with the cost of raising children. For parents in Colorado, the Child Tax Credit is set to undergo some changes in 2023. In this article, we will explore what the Child Tax Credit in Colorado looks like for 2023, how it can benefit families, and address some frequently asked questions. Let’s dive in and learn more about the Child Tax Credit in Colorado for 2023.

What is the Child Tax Credit?

The Child Tax Credit is a tax benefit provided to eligible families to help offset the cost of raising children. It is designed to provide financial assistance to parents and guardians, helping them meet the various expenses associated with childcare. The credit can be particularly helpful for families in Colorado, where the cost of living can be high.

Changes to the Child Tax Credit in Colorado for 2023

Starting in 2023, there will be some notable changes to the Child Tax Credit in Colorado. These changes aim to expand the credit and provide greater support to families. Here are the key updates:

Increased Credit Amount

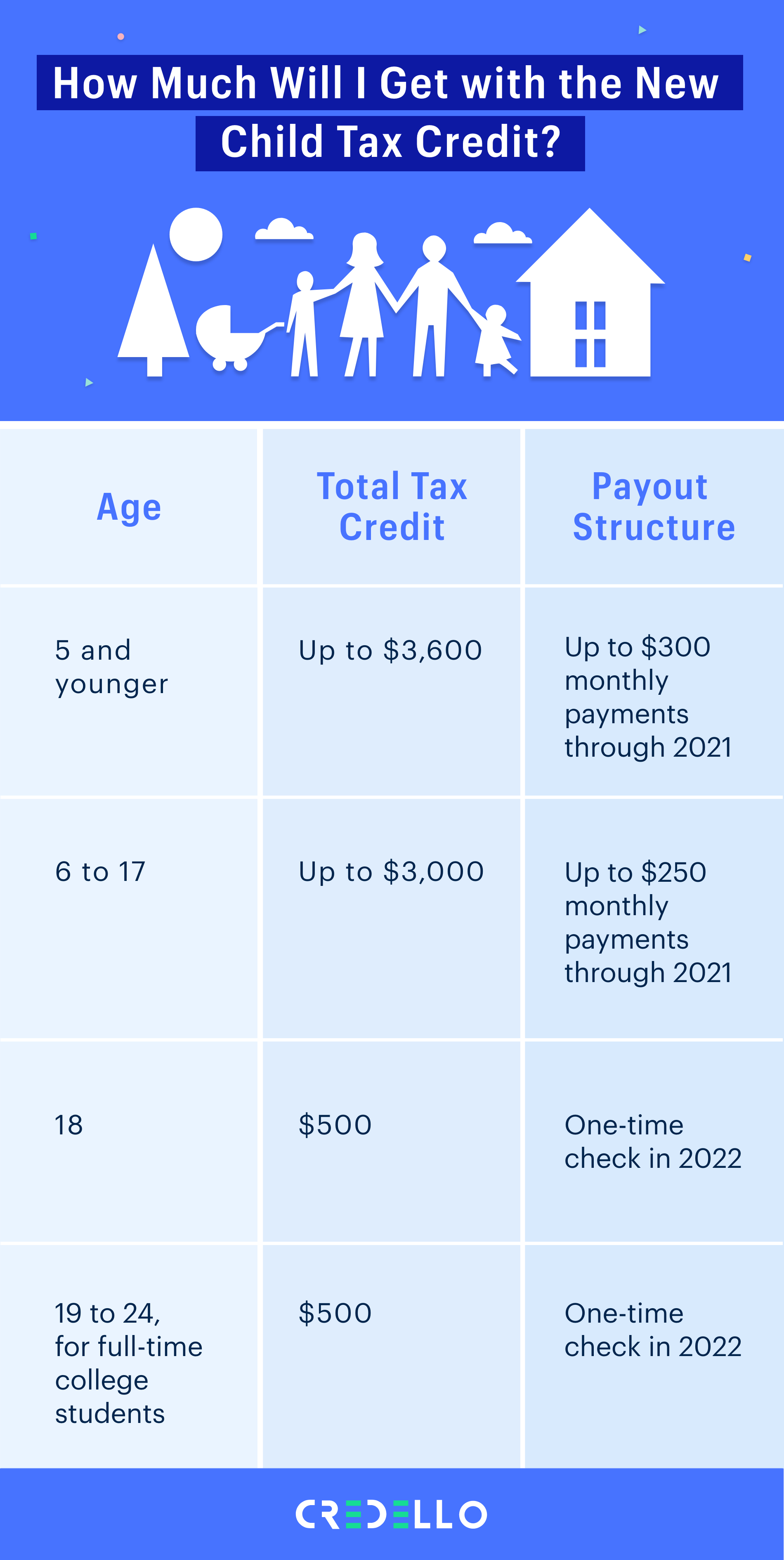

One significant change is that the maximum credit amount will increase. Currently, the credit is $2,000 per qualifying child. However, in 2023, this amount will rise to $3,000 per child aged 6 to 17 and $3,600 per child under the age of 6. This increase in the credit amount can provide families with more financial relief and help cover essential expenses.

Expanded Eligibility

Another important change is the expansion of eligibility for the Child Tax Credit. In addition to families who meet the existing income requirements, the credit will also be available to families with little or no income. This is a significant expansion that aims to support vulnerable families facing financial hardship.

Monthly Payments

Perhaps one of the most significant changes to the Child Tax Credit in Colorado for 2023 is the introduction of monthly payments. Rather than receiving the credit as a lump sum during tax season, eligible families will start receiving monthly installments in advance. These monthly payments will help families with their ongoing expenses and provide more immediate financial assistance.

Phase-out Thresholds

With the increased credit amount and expanded eligibility, it’s important to understand the phase-out thresholds. For families with higher incomes, the increased credits will start to phase out. The phase-out thresholds for the Child Tax Credit in Colorado for 2023 are as follows:

– For single filers: $200,000

– For married couples filing jointly: $400,000

It’s crucial for families to be aware of these thresholds to understand how they may impact their credit amount.

Child Tax Credit vs. Childcare Tax Credit: What’s the Difference?

While the Child Tax Credit and Childcare Tax Credit may sound similar, they are different benefits with distinct purposes. The Child Tax Credit is a credit designed to assist families with the overall cost of raising children. On the other hand, the Childcare Tax Credit specifically helps families cover the expenses associated with childcare, such as daycare or after-school programs. It’s important to understand the differences between these two credits to make the most of the available benefits.

Frequently Asked Questions

Now that we’ve covered the basics of the Child Tax Credit in Colorado for 2023 let’s address some frequently asked questions.

1. How do I know if I’m eligible for the Child Tax Credit in Colorado?

To determine your eligibility for the Child Tax Credit in Colorado, several factors are taken into account, including your income, the age of your child(ren), and your filing status. It’s essential to review the eligibility criteria provided by the Colorado Department of Revenue or consult with a tax professional to ensure you meet the requirements.

2. How do I claim the Child Tax Credit in Colorado?

To claim the Child Tax Credit in Colorado, you’ll need to include the necessary information when filing your state tax return. Be sure to have all the relevant documentation and follow the instructions provided by the Colorado Department of Revenue. If you have any questions or need assistance, consider reaching out to a tax professional.

3. Can I receive the Child Tax Credit if I have no income?

Yes, with the changes in 2023, families with little or no income may also be eligible for the Child Tax Credit in Colorado. This expansion aims to provide support to families facing financial hardships, ensuring they receive the assistance they need.

4. Will the Child Tax Credit affect my federal taxes?

The Child Tax Credit in Colorado is separate from the federal Child Tax Credit. While both credits aim to support families, they are governed by different rules and regulations. When filing your federal taxes, it’s essential to review the requirements and guidelines specific to the federal Child Tax Credit.

5. How can I ensure I receive the full Child Tax Credit amount in 2023?

To ensure you receive the full Child Tax Credit amount in 2023, it’s crucial to understand the eligibility requirements, provide accurate information when filing your taxes, and stay informed about any updates or changes to the credit. Keeping track of your child-related expenses and maintaining proper documentation can also help support your claim.

Final Thoughts

As 2023 approaches, the Child Tax Credit in Colorado undergoes significant changes that can benefit families. The increased credit amount, expanded eligibility, monthly payments, and phase-out thresholds all contribute to providing greater financial support to parents and guardians. It’s crucial for families in Colorado to stay informed about these changes and take advantage of the available benefits. If you have any questions or need guidance, consider consulting with a tax professional who can provide personalized advice based on your unique circumstances. Remember, the Child Tax Credit is designed to assist families in meeting the expenses of raising children, making a positive impact on both their financial well-being and the well-being of their children.