Montana Earned Income Tax Credit: Boosting Income for Working Families

**What is the Montana Earned Income Tax Credit (EITC) and how does it benefit working families?**

The Montana Earned Income Tax Credit (EITC) is a refundable tax credit designed to provide additional income support to low and moderate-income working individuals and families. Similar to the federal EITC, the Montana EITC is intended to incentivize work, reduce poverty, and offset the impact of regressive taxes.

**Eligibility criteria for the Montana EITC**

To qualify for the Montana EITC, individuals or families must meet certain requirements. These include:

1. Income: The household’s earned income and adjusted gross income must fall within specified limits. The income limits vary depending on the taxpayer’s filing status (e.g., single, married filing jointly) and the number of qualifying children they have.

2. Residency: Taxpayers must be Montana residents for at least six months of the year to be eligible for the credit.

3. Age: Taxpayers must be at least 18 years old to claim the Montana EITC.

**The benefits of the Montana EITC**

1. Increased income: The Montana EITC provides eligible taxpayers with a percentage-based credit on their earned income. This credit can significantly boost the income of working families, giving them more financial stability.

2. Poverty reduction: By providing additional income to low and moderate-income individuals and families, the Montana EITC helps to alleviate poverty in the state. It provides a much-needed lifeline for those struggling to make ends meet.

3. Work incentive: The EITC is designed to encourage individuals to enter and remain in the workforce. The credit is only available to individuals who have earned income, creating a direct link between work and the credit received. This incentivizes individuals to seek employment and promote financial independence.

4. Offsetting regressive taxes: The Montana EITC serves as a mechanism to offset the burden of regressive taxes on low-income individuals. Regressive taxes, such as sales and property taxes, can disproportionately affect low-income households. The EITC helps to level the playing field by providing targeted financial assistance.

**Calculating the Montana EITC**

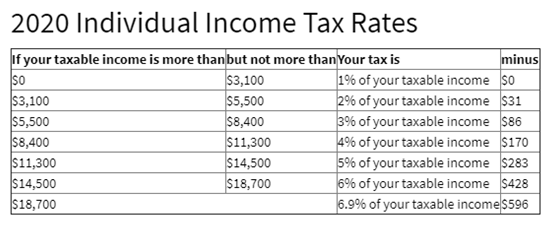

The Montana EITC is calculated as a percentage of the federal EITC. The percentage varies depending on the taxpayer’s income level, filing status, and the number of qualifying children. The Montana Department of Revenue provides a table that taxpayers can use to determine their eligibility and the amount of credit they can claim.

**Claiming the Montana EITC**

To claim the Montana EITC, taxpayers must file a state tax return (Form 2) and complete the corresponding EITC schedule. The schedule requires taxpayers to provide information about their income, filing status, and the number of qualifying children. They must also include any necessary supporting documentation.

**Frequently Asked Questions**

Frequently Asked Questions

Q: How does the Montana EITC differ from the federal EITC?

The Montana EITC is closely modeled after the federal EITC but operates at the state level. The eligibility criteria and income thresholds may differ slightly, as they are based on Montana’s specific tax laws and regulations. However, the underlying purpose and benefits of the Montana EITC are similar to the federal program.

Q: Can I claim both the federal and Montana EITC?

Yes, eligible taxpayers can claim both the federal and Montana EITC. The federal EITC is claimed on the taxpayer’s federal tax return, while the Montana EITC is claimed on the state tax return. However, it’s important to note that the Montana EITC is calculated as a percentage of the federal credit, so the amount of the Montana credit will depend on the federal credit claimed.

Q: What is the maximum amount of the Montana EITC?

The maximum amount of the Montana EITC varies depending on the taxpayer’s income, filing status, and the number of qualifying children. The Montana Department of Revenue provides a table that taxpayers can use to determine the maximum credit amount they are eligible for.

Final Thoughts

The Montana Earned Income Tax Credit plays a crucial role in supporting working families and reducing poverty in the state. By providing additional income and offsetting regressive taxes, the EITC serves as a lifeline for those who need it most. It not only incentivizes work but also promotes financial independence and stability. As the cost of living continues to rise, programs like the Montana EITC are essential in ensuring that hardworking individuals and families can thrive and succeed.