The Dependent Care Tax Credit 2017: A Comprehensive Guide

If you’re a working parent, you may already know how expensive and challenging it can be to secure reliable childcare for your children. To help alleviate some of the financial burden, the IRS offers the Dependent Care Tax Credit, which can provide significant tax savings for eligible families. In this comprehensive guide, we will delve into all the key details you need to know about the Dependent Care Tax Credit for the tax year 2017.

What is the Dependent Care Tax Credit?

The Dependent Care Tax Credit is a tax credit offered by the IRS to help working parents cover the costs of childcare or adult-dependent care. It allows eligible taxpayers to claim a credit based on the qualified expenses they paid to care for their dependents while they were working or looking for work.

Who is eligible for the Dependent Care Tax Credit?

To be eligible for the Dependent Care Tax Credit, you must meet the following criteria:

1. You must have incurred expenses for the care of a child under the age of 13, a disabled spouse, or a disabled dependent.

2. You must have earned income during the tax year. If you are married, both spouses must have earned income, unless one spouse was either a full-time student or disabled.

3. You must have paid for qualifying care expenses for your dependent. These expenses must enable you to work or look for work.

4. You must have a filing status of single, married filing jointly, head of household, or qualifying widow(er) with a dependent child.

How much is the Dependent Care Tax Credit worth?

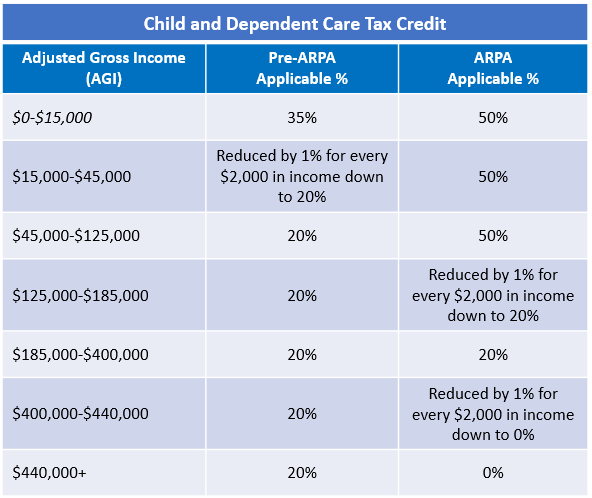

The value of the Dependent Care Tax Credit depends on your adjusted gross income (AGI) and the amount of qualified expenses you paid. The credit is calculated as a percentage of your eligible expenses, ranging from 20% to 35% of the expenses. However, the maximum amount of qualified expenses that can be considered for the credit is $3,000 for one qualifying individual or $6,000 for two or more qualifying individuals.

What are the qualifying expenses for the Dependent Care Tax Credit?

To claim the Dependent Care Tax Credit, you must have incurred qualified expenses for the care of your dependent. These expenses can include:

1. Daycare or preschool fees

2. After-school care programs

3. Babysitter fees

4. Summer camp fees

5. Household services directly related to care, such as cooking and cleaning

6. Expenses for care provided by a relative, as long as they are not your dependent

It’s important to note that expenses paid to a relative under the age of 19 or your spouse cannot be claimed for the credit.

How to claim the Dependent Care Tax Credit?

To claim the Dependent Care Tax Credit, you need to file Form 2441, “Child and Dependent Care Expenses,” along with your federal tax return. You will need to provide the name, address, and taxpayer identification number of the care provider, as well as the total amount of qualified expenses paid.

Frequently Asked Questions

Q: Can I claim the Dependent Care Tax Credit if I use a babysitter who is not licensed or registered?

A: Yes, you can claim the credit for expenses paid to a babysitter, even if they are not licensed or registered. However, you will need to provide the babysitter’s name, address, and taxpayer identification number when you file your taxes.

Q: What if I have more than one child and they attended different childcare programs?

A: If you have more than one child and they attended different childcare programs, you can still claim the Dependent Care Tax Credit for each child, as long as the expenses were incurred while you were working or looking for work.

Q: Can I claim the Dependent Care Tax Credit if I have a flexible spending account (FSA) for dependent care?

A: No, you cannot double-dip and claim the Dependent Care Tax Credit for expenses that were paid with funds from your FSA. You can only claim the credit for expenses that were not reimbursed through the FSA.

Final Thoughts

The Dependent Care Tax Credit can provide significant tax savings for working parents who incur childcare expenses. It’s important to keep track of all your qualified expenses and save your receipts to ensure accurate reporting when filing your taxes. Consulting with a qualified tax advisor can also help you navigate the complexities of claiming this valuable credit. So take advantage of the Dependent Care Tax Credit and reduce your tax burden while providing the best care for your dependents.

References:

– IRS: Child and Dependent Care Expenses (https://www.irs.gov/forms-pubs/about-form-2441)

– IRS: Topic No. 602 – Child and Dependent Care Credit (https://www.irs.gov/taxtopics/tc602)