Earned Income Tax Credit (EITC) in Washington: Helping Working Families Thrive

The Earned Income Tax Credit (EITC) is a powerful tool that helps working families and individuals by reducing their tax burden and providing financial support. Known as the “Kem Washington EITC,” this program aims to alleviate poverty and encourage economic mobility by providing a refundable tax credit that supplements the income of low and moderate-income households.

Understanding the Earned Income Tax Credit

The EITC is a federal tax credit established in 1975 and has since become one of the largest anti-poverty programs in the United States. It is designed to benefit low to moderate-income individuals and families, particularly those with children. The credit is based on your earned income, which includes wages, salaries, and self-employment income.

How Does the EITC Work?

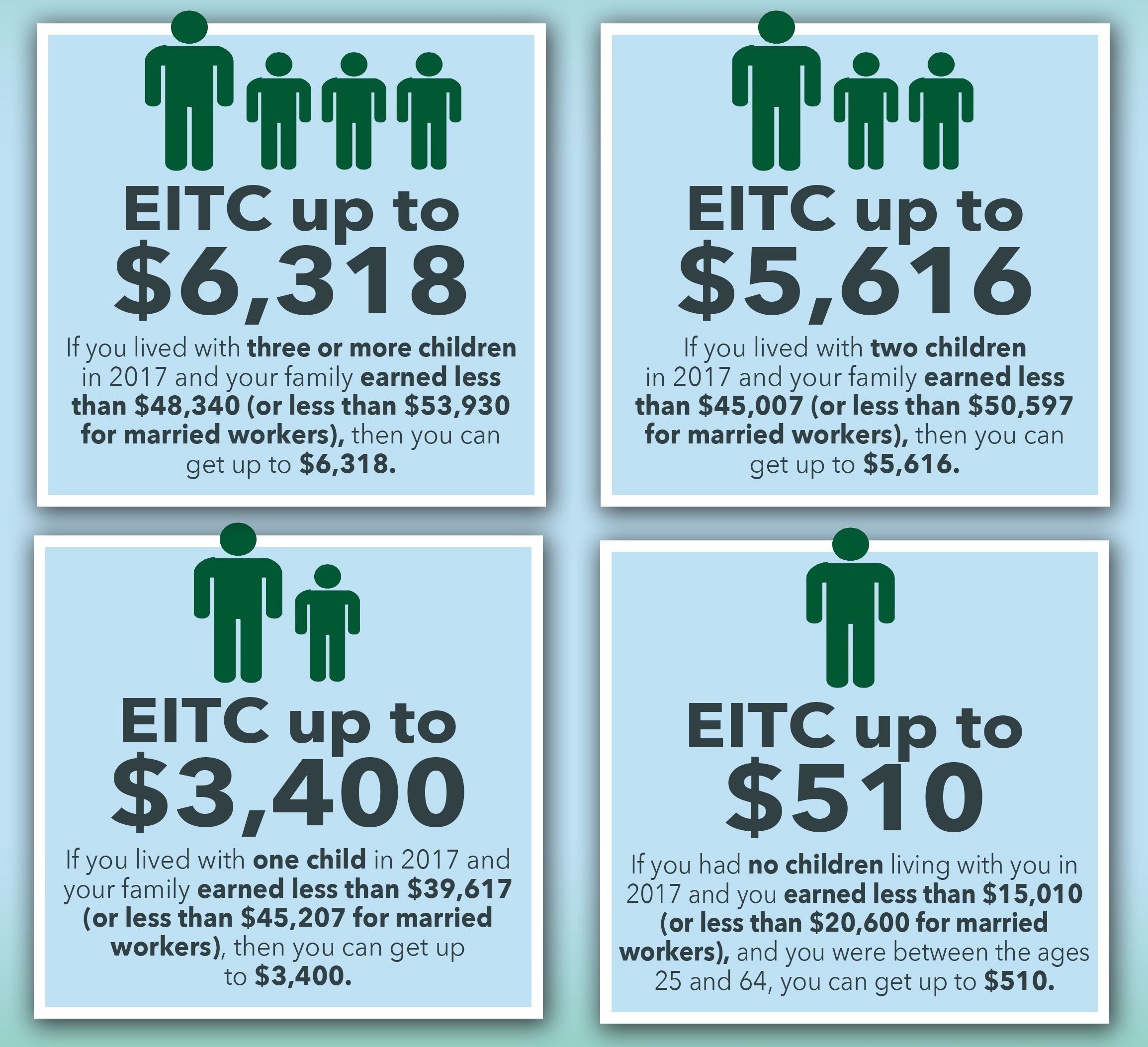

The EITC is a refundable tax credit, which means that even if you owe no federal income tax, you could still receive a refund if you qualify. The credit is calculated on a sliding scale, based on your income and the number of qualifying children you have.

The EITC is particularly beneficial for families with children. The credit amount increases as your income rises, allowing individuals and families to keep more of what they earn. For those without children, the credit is lower but can still provide a significant boost to their income.

Who Qualifies for the EITC?

To qualify for the EITC, you must meet certain criteria. These include:

1. Earned Income: You must have earned income from employment or self-employment.

2. Filing Status: You must file as Single, Head of Household, or Married Filing Jointly. Not applicable for Married Filing Separately.

3. Income Thresholds: Your earned income and adjusted gross income must fall below specific thresholds. These limits vary depending on your filing status and the number of qualifying children.

4. Residency: You must have a valid Social Security number and reside in the United States for more than half of the tax year.

5. Age Requirements: You must be at least 25 years old but younger than 65 at the end of the tax year. There is an exception for qualified disabled individuals.

EITC in Washington: The Kem Washington EITC

The state of Washington recognizes the importance of the EITC and has taken steps to provide an additional boost to working families and individuals through the Kem Washington EITC. This state-level credit complements the federal EITC, allowing eligible residents to claim both credits.

How Does the Kem Washington EITC Work?

The Kem Washington EITC is based on a percentage of the federal EITC you are eligible for. The credit percentage ranges from 10% to 50% of the federal credit, depending on your income level. To claim the Kem Washington EITC, you must first qualify for the federal EITC.

The Kem Washington EITC is refundable, meaning you could receive a refund even if you owe no state income tax. This additional credit can make a significant difference in the financial well-being of low to moderate-income families and individuals across the state.

How to Claim the Kem Washington EITC?

To claim the Kem Washington EITC, you must file a tax return with the Washington State Department of Revenue and provide the necessary documentation to support your eligibility. This includes proof of income, the number of qualifying children, and any other requirements specified by the state.

Frequently Asked Questions

1. Can I claim both the federal EITC and the Kem Washington EITC?

Yes, if you qualify for the federal EITC, you can also claim the Kem Washington EITC. The state credit is designed to supplement the federal credit and provide additional support to working families and individuals in Washington.

2. How much money can I receive from the EITC?

The amount of money you can receive from the EITC depends on various factors, including your income, filing status, and the number of qualifying children. The credit amount is calculated on a sliding scale, with higher income levels receiving a smaller credit.

3. Is the EITC only available to families with children?

No, although the EITC provides a higher credit amount for families with children, individuals without children can also qualify for the credit. The credit amount for individuals without children is generally lower but can still provide a significant boost to their income.

4. What if I don’t owe any taxes?

Even if you don’t owe any taxes, you may still be eligible for a refund if you qualify for the EITC. The EITC is a refundable credit, which means that if the credit amount exceeds any taxes owed, you can receive the excess amount as a refund.

Final Thoughts

The Earned Income Tax Credit, including the Kem Washington EITC, is a crucial program that supports working families and individuals in their pursuit of economic stability. By providing a financial boost, this program helps alleviate poverty, reduce inequality, and promote upward mobility.

If you believe you may be eligible for the EITC, it’s essential to explore your options and ensure you claim the credits you deserve. The EITC can make a significant difference in your financial situation, providing much-needed support and ensuring that your hard work is recognized and rewarded.

By taking advantage of the EITC and the Kem Washington EITC, you can make strides towards a more prosperous future for you and your loved ones. Don’t hesitate to consult a tax professional or utilize online resources to ensure you maximize the benefits of these valuable tax credits.